Over the last 6 years, the Australian stock market has fallen only twice in May, as denoted by the following table for the S&P ASX200 index.

|

Year |

Start of May |

End of May |

Point Gain/Loss |

% Gain/Loss |

|

2011 |

4,823.2 |

? |

||

|

2010 |

4,807.4 |

4,429.7 |

-377.7 |

-7.8% |

|

2009 |

3,780.5 |

3,817.8 |

+37.3 |

+0.9% |

|

2008 |

5,595.4 |

5,654.7 |

+59.3 |

+1.1% |

|

2007 |

6,166.0 |

6,313.5 |

+147.5 |

+2.4% |

|

2006 |

5,258.8 |

5001.7 |

-257.1 |

-4.9% |

|

2005 |

3,983.2 |

4,106.4 |

+123.2 |

+3.1% |

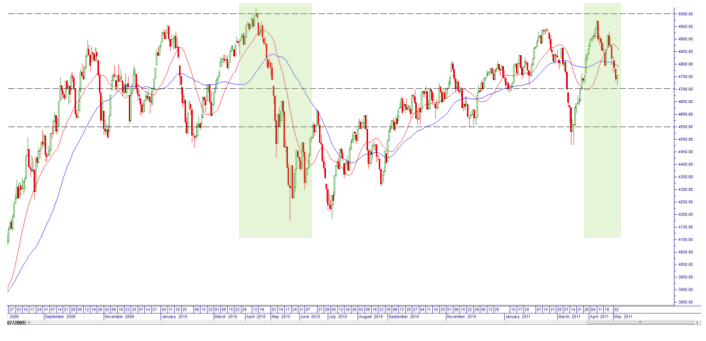

At time of writing, the benchmark market index was down 1.4% for May 2011, although with 3 weeks left for the month, anything could happen! A comparison of the Australian S&P ASX200 index for April/May 2010 and April/May (to date) 2011, reflects a very interesting picture:

- Both indexes had peaked at long-term highs in mid-April: 2010 @ 5,025 and 2011 @ 4,976

- The Australian dollar fell away from long-term highs: In 2010 the AUD fell from 93 cents to 81 cents within a month – down 13%. To date in 2011, the AUD has fallen from all time highs of $1.10 to current value of $1.06 – down only 3.6%

- Sovereign debt issues plagued Europe. Greece was headlining the news in 2010, whereas Portugal and the US are headlining in 2011.

- Metal prices were hit pretty hard over doubt’s of China’s growth prospects (right or wrong)

- In 2010, investors were worried about the “Resources Super-Profits Tax”. In 2011, investors are concerned about the “Carbon Pricing Mechanism”.

The similarities are immense. A final look at price activity sums it up:

In both events, the markets had experienced a strong upwards run based on solid market sentiment. Triggers caused profit taking. Eventuating into panic selling. In the former’s case, it was the Greek debt issue. In the current scenario. It is the US debt issue. And accompanied by a low US dollar and overbought commodity prices.

Not all is Doom and Gloom …

But just like we had seen in 2010, the worries about China are misleading. Even if the economy were too slow. It would still continue to grow at a greater rate than any other country in the world. The demand for resources from Australia will continue. And securing jobs and ensuring money flow continues.

Commodity prices will (eventually) stabilize due to global demand stemming from China, India and Japan. They were at extremely high prices leading into the recent market high, resulting in profit taking.

The AUD will also stabilize, and is likely to attract investors again. The AUD has fallen due to a rise in the USD as investors have flocked to this ‘perceived’ safe haven. Fears in Europe over the Euro caused a relief rally in the USD, however, the medium-term outlook remains bearish as there is no cause as to why the USD should return to a bullish trend. We could expect a short-term rally, but for further depression in price.

The US government won’t let the country fall into the same debt trap that Greece, Ireland, Iceland, and more recently Portugal have fallen into. They will do what it takes to ensure the US remains on the recovery path.

Our Outlook ….

Firstly, if the benchmark index holds 4,700 points. Then we are likely to find buyer accumulation. Resulting in a rally back towards the long-term highs. We see this as an Accumulation opportunity. And will be monitoring the markets accordingly.

A break of 4,700 is a worrying thought. It suggests the markets do not have any confidence in the current environment. This could see further panic selling just like in 2010. That causing the major market index to fall back towards 4,600 points.

For the time being, we need to ride through the negativity that is flowing from falling commodity prices. And a falling Aussie dollar. The long-term fundamental outlook remains stable with slight growth. Which is the underlying theme for investors.