Stock markets rise and fall. But it is very rare for a singular event. To cause global markets to plummet all at the same time.

As global trade has become more efficient. And economies become more intertwined with each other. The potential for markets to succinctly react in unison. To major fundamental events is increasingly more possible.

The future for share investing will not only rely on information from the local bourse. But from major country trading partners. And precedent set from key exchanges. Such as China, Japan, Germany and the US. Investment decisions will need to be made with a global perspective in mind.

A stock market crash is very different to a Bear market. Otherwise referred to as a Contracting Economy. Economies will expand and contract with cycles sometimes lasting years. More recently, the Australian economy experienced an Expanding economy between 2003 and 2008. And a Contracting economy between 2008 and 2009.

Historically, there have been very few major events. That have caused global stock market crashes. Typically, an individual country’s stock market will react. To news events that are influential to their own economic situation. Such as the release of increasing Inflation results. Or rising Interest Rates.

Some of the recent major global market crashes include:

- Global Financial Crisis (GFC) of 2007/08

- September 2011 Terrorist attacks on the US

- The Tech Wreck (dotcom bubble) of 2000

- Currency Crisis of 1997, and

- Black Monday 1987

In each of these situations, the markets have recovered. In some instances, such as the Sept11 Attacks on the United States. Buyer activity was evident on the Australian market. Within days of the event. Which represented a minor glitch in an overall long-term upwards trend. The realization that these terrorist attacks would have little impact on the Australian economy. Created a buying opportunity where investors had panic reacted.

Some events have a major impact on the economy of the country. Such as the Global Financial Crisis (GFC). The international exposure of the investment firms involved had a fundamental impact on numerous key economies. It took some time before investors found sufficient confidence to begin accumulating stock again. Of course, the GFC reverberated around the world, sending all major bourses into a spin. Australia was not immune to this activity, but recovered much more quickly due to a healthy economy and strong demand for commodities from China (our major exporting partner).

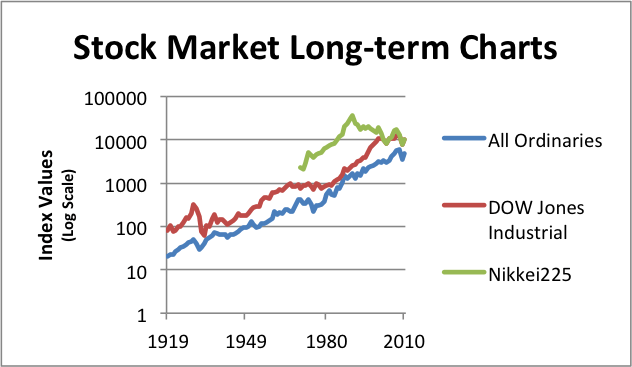

The above chart reflects the continued growth of the All Ordinaries and DOW Jones Industrial Average indexes which represent the Australian and US stock markets respectively. In comparison, the Japanese market (represented by the Nikkei225 index) has been in a Contracting economy for the last 20 years due to a fundamentally weak economy.

How Quickly will the markets Recover?

This current situation in Japan is a natural disaster that will impact the Japanese economy. The cost to stabilize the Fukushima Nuclear Power Plant, the cost to rebuild the cities and towns, and the lost revenue from an economy that has virtually ground to a halt will take time.

For Australia, Japan is our 2nd largest trading partner. Whilst there will be an impact on the immediate exports scheduled to be shipped to Japan, in the long run, Australia will be one of the major suppliers for raw materials required for the rebuild. This will bode well for our economy.

The negative reaction of the Australian markets is based purely on sentiment. Fear & Greed drive the markets, and the fear of Nuclear fallout has investors dumping their stock at an alarming rate. But the fundamentals haven’t changed!

Majority of stocks listed in Australia will not be impacted by the current events. Mining stocks are exposed, and more specifically, Uranium mining stocks. But the Australian Mining sector is very diverse with the Uranium industry only a small component of this sector.

This leaves us with what to do right now?

With the Australian market having fallen more than 8% in the last 2 weeks, without a major fundamental catalyst other than the sentimental reaction of fear driven investors, we view this as a perfect opportunity to buy fundamentally strong companies.

On our radar are core companies such as BHP & WOW. We currently have Buy alerts on both of these companies.

Protection strategies for these companies can be adopt for those investors who have concerns that the markets might fall further. Your adviser can discuss.