No matter what your political or emotional perspective towards Nuclear Energy, reality is that the world needs electricity and will only need more in the future. Electricity is a necessity, just like food and water. Without it, society cannot function and would in-fact revert to an apocalyptic world!

In this article, we take a look at the world’s insatiable need for electricity, Australia’s history with the commodity, and what investment opportunities exist ….

Uranium mining in Australia has been evident since 1906, when radioactive ores were first extracted from Radium Hill in South Australia. Early uses of uranium ore was for the medical field before the mid 1950’s when ore was provided to the UK and USA for their nuclear weapons programs.

Presently, uranium is only mined in Australia for the use of electrical power generation and nuclear research. It is sold to selected countries that are signatories to the Nuclear Non-Proliferation Treaty and exported under guidelines stipulated by the International Atomic Energy Agency.

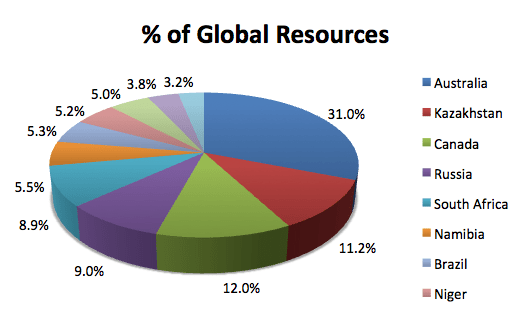

Despite not using Nuclear Power Plants to generate electricity within Australia, we have the world’s largest reserves of Uranium totalling 31%. Since 2004, production and exports has averaged 9600 tonnes of uranium oxide with 9700 tonnes to the value of $AUD1.1Billion in 2009.

Australia’s policy towards uranium mining was the “Three Mine Policy” established by the federal Labor government under Bob Hawke. After this policy was dumped by the Howard government, a 4th uranium mine was approved in July 2009. The 3 operational uranium mines currently in Australia are:

1) Olympic Dam mine (South Australia)

2) Ranger Uranium mine (Northern Territory)

3) Beverley Uranium mine (South Australia)

There are numerous other known deposits, and uranium is also an ancillary product from many other mines across the country. Approved for development are the Four Mile uranium mine and the Honeymoon uranium mine, both in South Australia.

Global Demand for Uranium expanding due to the insatiable need for Electricity …

The world needs more energy supply due to a growing population. Especially “clean” generated electricity. From 1980 to 2007, the total world primary energy demand grew by 66%. By 2030, it is estimated to grow at 76% with Asia the highest demand region. As of 2009, there were 2 billion people who did not have access to electricity!

An increasing global population will only put further pressures on the demand for electricity with the highest demand coming from developing countries such as India and China.

How this electricity is produced is the key for future investment.

Despite the fears generated by the Japanese Fukushima Dai-ichi nuclear power plant, future electricity is still going to be generated by nuclear power.

Political debate has opened up for renewable energy and clean electricity. The problem is that infrastructure, the cost to develop new facilities, and the capital already invested into new nuclear facilities cannot be replaced by alternative fuels.

For the foreseeable future, the first course of action is to replace “Dirty Fuel” generators (Coal and Oil) with Clean Fuel sources such as Natural Gas and Nuclear. As we can see from the following table, Coal and Oil account for more than 60% of the global energy source. This is a phenomenal amount to replace.

Reality is, even though society would prefer not to have a dangerous energy source such as nuclear, we cannot cater for future demand of electricity without either increasing the use of Coal & Oil at the cost of the environment (and with diminishing global resources), or finding an alternative for Nuclear.

In our article titled Thorium vs Uranium, we have outlined a safe alternative that can utilize existing facilities. Opportunities for future development in Thorium have the opportunity to be the next booming industry, and again, Australia has the largest amount of known deposits.

The above image from the World Nuclear Association, depicts the number of Operational Nuclear power plants and those that are under construction. China, Russia and India are the leading advocates for development of new facilities, in direct need to cater for exploding populations and economic growth.

Use of nuclear energy is only increasing, and subsequently the demand for uranium will continue to grow. The 440 reactors currently in operation require 65,500 tonnes of uranium each year. With more than 60 new reactors currently under construction (across 15 countries), that demand is only set to grow.

This has Australia poised to profit in much the same manor that we have profited in Mining from the high demand in iron ore, coal and LNG. With that in mind, the savvy investor should ensure they have exposure to this great opportunity.