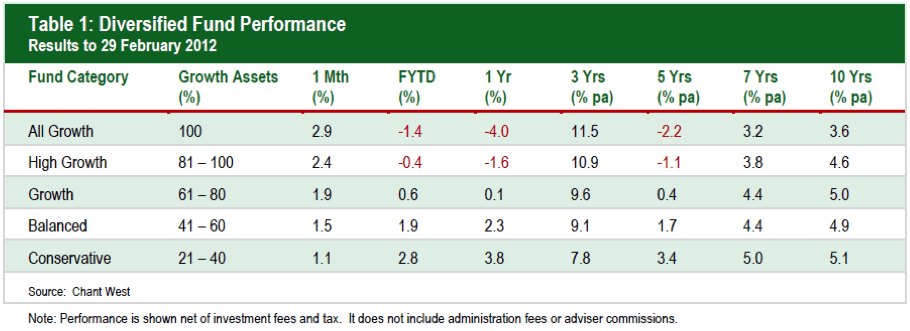

Chant West’s research shows the median return from the 25 largest conservative funds for the 12 months to the end of February was 3.8 per cent, compared to 0.6 per cent from growth funds.

Over the past five years, conservative funds returned a median 3.6 per cent a year, more than triple the 1.1 per cent achieved in the growth category.

The GFC pushed growth funds down about 27 per cent from late October, 2007, to the end of February, 2009

Average fund shrunk in value by two per cent in 2011 – Chant West

By contrast in 2008, funds lost an average of 21.5 per cent … even after a 15.1 per cent rise in 2009 and 4.7 per cent return in 2010, many funds “still have some ground to make up”

Source: www.apra.gov.au

The number of SMSFs grew by 7.2 per cent to 442,528 funds during the 2011 financial year

There have been more negative quarterly RORs in the most recent five year period than the two

preceding five-year periods.

For the 15 years to June 2011 the annual ROR for the industry was typically17 between —6.8 and 12.9 per cent per annum

The average industry-wide ROR for the most recent five-year period was lower than the two

preceding five-year periods

the long-term average industry-wide ROR over the 15-year period was 5.2 per cent per

annum. This provides a real return (above 15-year average inflation of 2.7 per cent per annum) of

2.5 per cent per annum

For the 197 entities which existed for the whole 15-year period, most (50 per cent) funds had a 15-

year average fund-level ROR of between 3.9 and 6.5 per cent per annum.