At what cost do we save the environment? As the debate continues on how the Gillard Government will release their Carbon Price Mechanism to parliament in the Spring, investors ponder what impact it will have on the economy. All analysts agree that there will be a direct impact to consumers in the form of higher costs to electricity, fuel and manufactured goods. But how will this impact listed stocks?

The taxes will derive from:

- Emissions from manufacturing/production

- Transportation

- Competitive disadvantage from imports with no carbon tax

The obvious companies that will lose out from the Carbon tax are from the Energy & Mining sector. The likes of BHP, RIO, CTX and BSL to name a few. In essence, these are the stocks that are propping up our economy against a slow global recovery following the GFC (Global Financial Crisis).

Looking towards the second half of the year, if we haven’t had a reasonable market correction by that time, then this could be the catalyst. Global markets are tentatively hanging on in light of all the geopolitical events that have occurred over the last few years. Such as the GFC, Greece/Ireland/Portugal sovereign debt issues, the ongoing war against terror, and natural disasters. For Australia, we are far from being back in an established Booming economy, so why rock the boat?

The only advocates of the Carbon Tax, outside of the Government, are the Greens and their supporters. This tax is about helping alleviate the problem of Green House Gas emissions that are causing pressures on Global Warming. And while Europe has been on the bandwagon for more than a decade, implementing taxes and changes to industry gradually over that time, Australia is looking to jump straight into the deep end.

Our economy has been established on a booming mining trade with China, Japan and India, exporting mineral ores that require a high level of extraction and processing. The very things that will be taxed by the Gillard Government’s Carbon Pricing Mechanism (CPM).

So let’s take a look at the impacts of the Carbon Tax on the Australian stock market, which companies are likely to suffer and which are likely to benefit.

Emissions taxing to save the planet. Who will save our Miners?

The impact of a Carbon Tax on the Australian economy will be significant enough to affect the stock market. Increased costs of electricity and fuel (transportation) will be directly passed through to consumers, impacting savings and investment ability.

Carbon Tax is an indirect tax implemented by a government to levy the use of fossil fuels. Advocates for implementing a carbon tax believe that it is an imperative step in helping alleviate the problems of Global Warming.

The first Carbon Tax was implemented in Sweden on January 1st 1991. Other northern European countries followed, with Finland, Netherlands and Norway introducing similar taxes through the 90’s.

On the 11th Dec 1997, the Kyoto protocol was initially adopted, but was not entered into force until 2005. Under this protocol, 37 countries committed to a reduction of 4 key greenhouse gases:

1) Carbon Dioxide,

2) Methane,

3) Nitrous Oxide, and

4) Sulfur Hexaflouride

Former Prime Minister Kevin Rudd attempted to introduce an emissions trading scheme known as the Carbon Pollution Reduction Scheme (CPRS) in an effort to meet the needs of the Kyoto agreement. This was deferred as there was no public support for an additional “tax” to consumers.

More recently, the Gillard Government has announced that a Carbon Emission tax would be introduced in July 2012. While details of the tax have not been tabled, most reports have been using the previous Rudd CPRS scheme to define the cost to consumers. Until the Gillard government puts the legislation to parliament, we will all be in the dark to how much impact there will be on consumers, businesses and the economy.

In the meantime, short-term impacts to related companies during the negotiations and passing of legislation through Parliament are expected. In addition to long-term impacts that companies will pass on costs to consumers. Not only will there be a direct increase in costs due to the levy, but the ability to change to low carbon technologies will incur new capital costs.

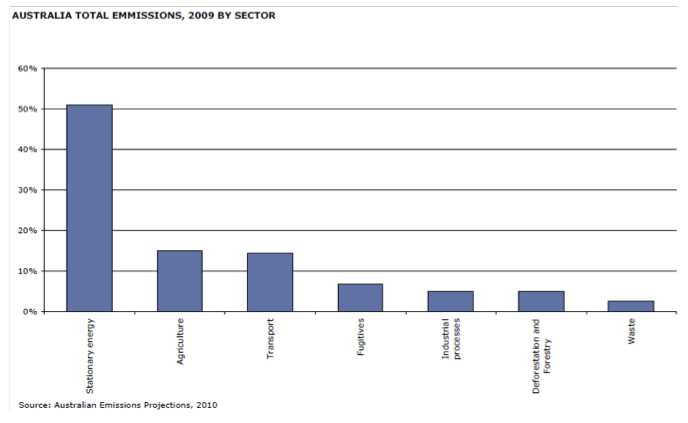

As outlined in the above graph, 2009 figures denote the majority of our green house gas emissions emanate from the Energy sector. Subsequently, this is the sector that will be most impacted from a new carbon tax system. Again, the very sector that has kept us from following the US from falling from prosperity.

When the Australian Government announced the introduction of the new Carbon Tax – referred to as the Carbon Price Mechanism (CPM), no details were provided. Subsequently, the market reacted with volatility and remains in a flux of uncertainty.

“A carbon price is a price on pollution. It is the cheapest and fairest way to cut pollution and build a clean energy economy. The best way to stop businesses polluting and get them to invest in clean energy is to charge them when they pollute,” the Government said in a press release.

The intention is for the government to introduce legislation to parliament during the spring sittings. In the meantime, they will be preparing the legislation, conducting analysis and engaging with stakeholders to formulate the final plan. Analysts are using the previously proposed Carbon Pollution Reduction Scheme (CPRS) as a reference point to what the government is likely to build their legislation from.

There are 2 key points that will define the affect the Carbon Price Mechanism will have on specific stocks:

1) The level of carbon price, and

2) The compensation arrangements

For the average consumer, the main impacts Carbon Pricing will have on households are:

- Electricity costs

- Gas and other heating fuels

- Petrol prices

- Higher prices on manufactured goods and services which are impacted by emission taxing.

To put that into perspective, the government and CSIRO had conducted some price modelling on the previous Carbon Pollution Reduction Scheme (CPRS). These included figures such as:

- Electricity prices were expected to increase approximately 16%

- Petrol Prices expected to increase approximately 12 cents per litre.

- The average price of all goods is expected to increase 0.9%

To compensate consumers, the government is likely to offset personal income tax. Specifically for low and middle income households. But the impact on the economy is going to be much greater, causing inflationary pressures and indirect price rises across a vast basket of goods. For this reason, the government will need to be extremely cautionary in implementing any future changes.

Although both sides of the Carbon Tax debate have merit to why or why not it should be introduced, investors are left to ponder how the stock markets will be affected. Those stocks that will benefit are those that will not incur the additional costs of a carbon emission levy or require technological upgrades. Those that will suffer will incur the tax.

We would all like to live in a healthy, pollution free environment. And to leave our future generations with a canvas to prosper and live well. But someone has to accept the cost of change, and it looks like now is the time.

The Good, the Bad and the Ugly

Because the production of Electricity is the largest source of greenhouse gas emissions, the Energy sector will be the biggest target for any reduction scheme. Without compensation from the government, there would be significant disruption to financial markets and higher risk premiums on new investments. The end result, higher cost to the consumer. Opposition to a Carbon tax state it will increase the chance that Australia could struggle to produce enough electricity and could suffer ‘brownouts’.

In the firing line for the Carbon Pricing Mechanism (CPM) are companies such as:

| Code | Company | Industry | Notes |

| VBA | Virgin Blue | Transportation | |

| CTX | Caltex | Energy | |

| AWC | Alumina | Materials | |

| BSL | BlueScope Steel | Materials | |

| QAN | Qantas | Transportation | |

| ORG | Origin | Energy | |

| OST | OneSteel | Materials | |

| WPL | Woodside Petroleum | Energy | |

| BHP | BHP Ltd | Materials |

Companies that will benefit from the Carbon Tax are Renewable Energy and Low-Carbon companies. This is a weak sector in the Australian market. By 2030, if Australia successfully transitions towards a cleaner, greener energy sector, up to 43% of our electricity could be produced from clean energy. That’s an increase of 31% from the current 12% produced today.

But this will require major changes to our infrastructure and government policies.

Many of the renewable energy companies in the Australian markets are low capitalized, or speculative companies. This means there is lower trading volumes, and an uncertainty about their future.

Companies listed in the Renewable Energy sector include:

|

Code |

Company | Industry | Market Cap$ (m) | Notes |

| SGM | Sims Metal Management Ltd | Waste |

$3,580 |

|

| TPI | Transpacific Industries | Waste |

$1,090 |

|

| CRG | Crane Group | Water |

$806.95 |

|

| ENE | Energy Developments | Biogas |

$410.35 |

|

| IFN | Infigen Energy | Wind |

$296.88 |

|

| GXY | Galaxy Resources | Energy & Efficiency, Green Buildings & Biomaterials |

$261.06 |

|

| ORE | Orocobre | Energy & Efficiency, Green Buildings & Biomaterials |

$246.19 |

|

| NAN | Nanosonics | Energy & Efficiency, Green Buildings & Biomaterials |

$204.36 |

|

| TOX | Tox Free Solutions | Waste |

$192.39 |

|

| CFU | Ceramic Fuel Cells | Transport Technologies |

$144.16 |

|

| PEA | Pacific Energy | Biogas |

$142.27 |

|

| SLX | Sylex Systems | Solar |

$137.87 |

|

| DYE | Dyesol | Solar |

$113.16 |

|

| COF | Coffey Environments | Environment |

$99.43 |

|

| GDY | Geodynamics | Geothermal |

$96.76 |

|

| CWE | Carnegie Wave Energy | Wave |

$79.17 |

|

| QTM | Quantum Energy | Solar |

$66.79 |

|

| WAS | Wasabi Energy | Geothermal |

$61.99 |

|

| CBD | CBD Energy | Transport Technologies |

$61.53 |

|

| MBT | Mission NewEnergy | Biofuel |

$56.11 |

|

| COZ | CO2 Group | Carbon |

$37.65 |

|

| ARW | Australian Renewable Fuels | Biofuel |

$29.90 |

|

| VMT | Vmoto | Transport Technologies |

$22.45 |

|

| GCG | Greencap Ltd | Environment |

$21.53 |

|

| AEF | Australian Ethical Investment | Other |

$20.06 |

|

| AEI | Aeris Tech | Environment |

$18.81 |

|

| PHK | Phoslock Water Solutions | Water |

$14.91 |

|

| PTR | Petratherm | Geothermal |

$14.58 |

|

| BPO | BioProspect | Other |

$14.52 |

|

| CCF | Carbon Conscious | Carbon |

$9.64 |

|

| HMC | Hydromet | Water |

$7.91 |

|

| VIR | Viridis Clean Energy Group | Wind |

$2.79 |

|

| TSI | Transfield Services Infrastructure Fund | Wind | $ | |

| WFL | Willmott Forests | Biogas | $ |

List of Australia’s biggest Greenhouse Gas emitters:

|

Listed Company |

Stock Code |

Emissions million tonne/year |

| BlueScope Steel |

BSL |

10.8 |

| Woodside Petroleum |

WPL |

8.4 |

| BHP Billiton |

BHP |

8.3 |

| Alinta Energy |

AEJ |

7.9 |

| Rio Tinto |

RIO |

7.7 |

| Qantas Airways |

QAN |

4.0 |

| Santos |

STO |

3.6 |

| Adelaide Brighton |

ABC |

3.1 |