March 2020 will go down in history as one of the worst months EVER for the Sharemarket. Against this backdrop, many out there have been significantly financially harmed. No stops, buy and hold, “Big Safe Bluechips” have all conspired along with the Corona Virus to shred many investors accounts.

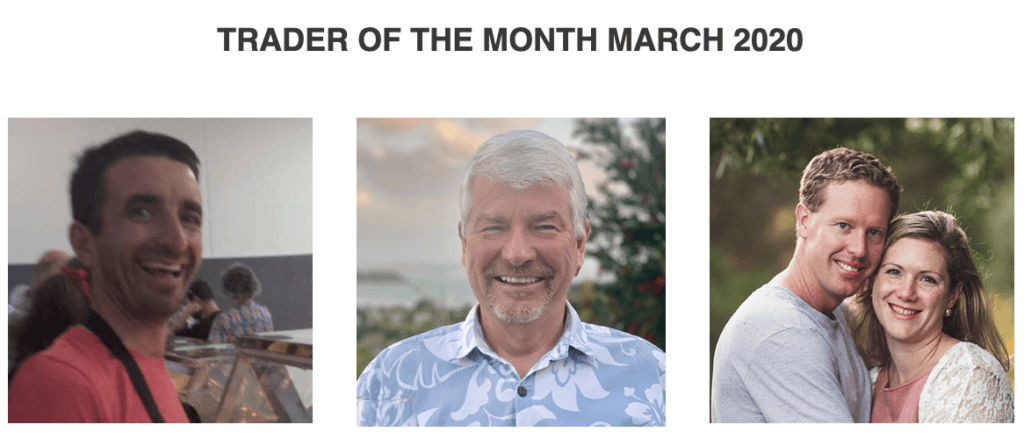

Not so for these guys and plenty of others. This month we have a three way split for Trader of The Month, not because we are indecisive, but because each of these Winners have their own story and more importantly are penning the ending the way they want, rather than that portrayed in the media.

Shane has been a client of ours for a while. I remember meeting him for the first time in Perth and from the get go, his intention was there. We have embarked on a deep journey into Advanced Options over that time and when I see the fruits of that hard work paying off against the background of some of the toughest trading conditions, I have immense pride and respect.

Shane grew his account through the month of March by 33.16% a truly outstanding effort – Look forward to having a Guinness with you matey, once we are out of Social Isolation. Please join me in congratulating Shane Comer as Trader of The Month March 2020

From: Shane Comer

To: “info@australianinvestmenteducation.com.au”

Subject: Trader of the Month Nomination for March

Hi Team

TOTM nomination for March.

A recap my trades during the month of March and what a month it has been.

AMN:NYSE

Date entered 3/3/20

Strategy: Long Call

Strike $80

Entry 1.50

Exit 3.10

Duration 15 days

Return 106%

MQG:ASX

Date entered 17/3/20

Strategy: Bear Call Spread

Strikes 110/108

Entry 0.865 Credit

Exit Options expired

Duration 9 days

Return 43%

BLDP:NYSE

Date entered 20/3/20

Strategy: Bear Call Spread

Strikes 9/8

Entry .1375 Credit

Exit Options expired

Duration 1 day

Return 13.75%

BLDP:NYSE

Date entered 20/1/20

Exited 4&12/3/20

Strategy: Long dated Strangle

Strikes 14/7

Entry 1.70

Exit 3.15

Duration 48 days

Return 85.29%

CBA:ASX

Date entered 31/3/20

Strategy: Bear Call Spread

Strikes 65/64

Entry .185 Credit

Exit Options Expired

Duration 2 days

Return 18.5% of maximum risk

BHP:ASX

Date entered 31/3/20

Strategy: Bear Call Spread

Strikes 31.5/31

Entry .10 Credit

Exit Options Expired

Duration 2 days

Return 20% of maximum risk

CSX:NYSE

Date entered 31/3/20

Strategy: Bear Call Spread

Strikes 59/58.5

Entry .16 Credit

Exit Options Expired

Duration 4 days

Return 32% of maximum risk

SQ

Date entered 31/3/20

Strategy: Bear Call Spread

Strikes 51/50

Entry .20 Credit

Exit Option Expired

Duration 4 days

Return 20% of maximum risk.

Thanks Andrew and his team for the knowledge I have gained from your education I am up 44.38% overall for the month of March.

Kind Regards

Shane Comer

Nick joined us toward the end of last year – I remember chatting with him and his wife, as they enrolled at the Robert Kiyosaki event. Since then he has diligently applied himself to the journey, working through both Cashflow On Demand and Wealth For Life. The result of that learning speaks for itself especially against the backdrop of the current market conditions.

It would be fair to say Nick is open and prepared to explore new strategies, a long way away from the traditional buy and hold approach. As a result, of not simply learning but stepping up and applying with action, he has generated a 28.64% return on his account. This year’s vintage may be a little fresh to celebrate with, my friend, but we all toast your success – great work! Please join me in also congratulating Nick Race as Trader of the Month March 2020.

From: Nick Race

To: “info@australianinvestmenteducation.com.au”

Subject: Trader of the Month Nomination

Hi GangI’d like to nominate myself for trader of the month (March). My trades were as follows

Strategy: Credit Spreads (Bear Calls, Bull Puts)

Fundamentals: Focus on industries negatively effected by Corona Pandemic and Oil War

Industries: Airlines (BA, AAL, DAL, UAL),

Cruise Lines (CCL, RCL, NCLH),

Car Rental (CAR, UBER),

Travel (EXPE),

Retail (M),

Oil (XOM)

Volatility: > 200% !!!

Expiry: < 7days (only select companies with weekly options, as visibility beyond the week unknown)

Results: Bear Calls 19 out 25 profitable (25%-95% yield)

Bull Puts 1 out of 3 profitable (30% – ZM)

Originally I was letting the options expire for 100% of Max profit, but then adjusted to take profits early @ 80% due to such high volatility.

I looked at other strategies for the month, but Debt Spreads and Straddles had option prices too high due to volatility.

Valuable lesson: Given that straddles were too expensive, I tried a credit spread across an earnings release (FDX) on the assumption that they would gap down (like the market). This proved not to be the case and stock rose immediately after earnings. Luckily I was able to get out the following day for a small profit due to overall market falling. Will only use Straddles (in less volatile markets) across earnings in future 🙂

Cheers

Nick Race

New Zealand

Mark joined us in October last year and has been approaching the market with great skill. Given his background in Photography, you may wonder how that relates to trading. I remember a terrific quote from my Fine Art and Photography tutor “everybody looks but only some people see” and trading is no different.

Mark has developed an appetite for seeing Volatility as an opportunity, not a threat and his trading of the VIX index through March has helped him generate a mammoth 73% return for the month. As a result, please help me also congratulate Mark Aitcheson on an outstanding month of trading as Trader of the Month March 2020

From: Mark James

To: “andrew.b@australianinvestmenteducation.com.au”

Subject: Trader of the Month Nomination

Hi Andrew

I hope you, your family, and the team are well. In Feb I had mixed success with stocks managing to get caught up in the choppy reporting season on the au market, but finished the month ahead thanks to some long positions I started taking in the vix around Feb 13 back when it was around $15.40. It feels crazy to be talking about the vix at those levels! It feels like an eternity ago. In hindsight, being a bit of a novice, I didn’t manage the positions as well as I could of, and only took $2400 profit. If I used a sliding stop and let it run, the profit could have been much more. All in hindsight!

This month (march) with volatility dominating the market, I’ve joined the dark side and day traded some of the crazy swings in the vix. I decided to adapt the vix trading plan, and so far it’s worked well. I’ve had some hits and some misses but I’ve come out in front for March. I started the month with $14K in my account and finish the month with $24K. Below are my trades. Total profit for the month $10256.50 for account growth of around 73%.

WES

Open 40.84

Close 40.61

-$11.50

ALT

Open 32.55

Close 32.31

-$16.80

Trans

Open 15.08

Close 15.04

-$5.20

Vix

Open 38.37

Close 38.67

+$160

Vix

Open 38.49

Close 38.7

+$42

Vix

Open 43.56

Close 43.44

-$24

Vix

Open 44.29

Close 44.41

+$60

Vix

Open 45.74

Close 45.43

-$155

Vix

Open 47.12

Close 46.91

-$210

Vix

Open 47.17

Close 50.47

+$1650

Vix

Open 46.05

Close 50.47

+$1326

Vix

Open 45.66

Close 50.47

+$962

Vix

Open 47.1

Close 50.47

+$1685

Vix (short position)

Open 45.52

Close 45.17

+$70

Vix (short position)

Open 47.48

Close 45.19

+$438

Vix (short position)

Open 58.15

Close 58.2

-$8

Vix (short position)

Open 58.22

Close 58.2

+$4

Vix (short position)

Open 58.15

Close 58.2

-$8

Vix (short position)

Open 56.7

Close 51.15

+$1110

Vix (short position)

Open 57.1

Close 51.15

+$1190

Vix (short position)

Open 53.81

Close 53.98

-$34

Vix (short position)

Open 54.33

Close 53.98

+$70

Vix (short position)

Open 53.7

Close 53.98

-$56

Vix

Open 54

Close 53.65

-$140

Vix

Open 61.90

Close 60.49

-$282

Vix

Open 62.55

Close 60.49

-$618

Vix

Open 68.55

Close 75.85

+$730

Vix

Open 70.77

Close 75.85

+$508

Vix

Open 70.64

Close 75.53

+$978

Vix

Open 70.97

Close 75.53

+$912

Vix

Open 45.04

Close 45.52

-$48

Vix

Open 46.3

Close 46.25

-$5

Vix

Open 43.46

Close 44.14

-$68

Vix

Open 43.6

Close 43.76

-$16

Vix

Open 43.71

Close 43.76

-$5

Vix

Open 43.4

Close 43.76

-$36

Vix

Open 43.85

Close 43.60

-$50

Vix

Open 50.67

Close 50.1

-$57

Vix

Open 49.78

Close 51.65

+$187

Vix

Open 52.41

Close 51.65

-$152

Vix

Open 49.91

Close 51.65

+$174

It’s been so hard to pick between these three stories and as such, for the first time a three way tie – opportunity is everywhere if you look through the right lenses. Check out our soon to be launched Virtual Bootcamp, to brush up on your skills and join in some interactive classroom sessions, which will be of great benefit in the current climate. Once again massive and very sincere congratulations to this Month’s Traders of The Month, Shane Comer, Nick Race and Mark Aitcheson – inspirational and very much deserved.