“Investment” is now a global term. Due to technology, you can own a stock almost anywhere in the world. You can buy commodities, currencies, derivatives and indices. There is just no limit to what you can do from an investment point of view.

“Investment” is now a global term. Due to technology, you can own a stock almost anywhere in the world. You can buy commodities, currencies, derivatives and indices. There is just no limit to what you can do from an investment point of view.

With this wide range of potential opportunities, it can actually be quite daunting for the beginner investor. Where do you start? What do you invest in? Or, What will make me the most money?

A solution that I propose to you in answer to these questions is Exchange Traded Funds (ETF’s).

Exchange Traded Funds are an investment vehicle that is traded on a stock exchange. It will hold assets such as stocks, commodities, bonds or currencies, but is listed as a stock and traded accordingly. Some of the more popular ETFs include:

|

Code |

Name |

What it trades |

|

SPY |

SPDR S&P500 |

It holds the stocks that make up the S&P500 index |

|

USO |

United States Oil |

It holds futures contracts in West Texas Intermediate (WTI) light, sweet crude oil |

|

GLD |

SPDR Gold Shares |

Holds physical gold and gold futures, replicating the price movement of spot gold prices |

There are literally hundreds of various ETFs listed in the United States. Although other countries also offer ETFs through their exchanges, such as the Australian Stock Exchange (ASX). They not only offer the opportunity to purchase a listed fund that provides exposure to a group of stocks (such as the ASX200 or DOW Jones indices), commodities and currencies, but you can also gain exposure in “Inverse” markets.

For example, if you believed the stock market was likely to fall in value, instead of ‘shorting’ the market index, you could purchase stock in an Inverse related ETF. One example is SH. In the table above, purchasing the SPY provides you with exposure to the S&P500 index stocks. If this index rises, you will profit on the SPY. If the index falls, you will lose on the SPY. But the Exchange Traded Fund for SH provides the Inverse performance of the S&P500 index. So if the S&P500 rises, SH falls. But if the S&P500 falls, then SH will rise. Hence, you could purchase SH to benefit from a fall in the markets.

ETFs may be something new to you, or you may have heard of them in more recent years. Although it is the fastest growing market in the US, they have been around for more than a decade. They were first issued in 1993 in the US, and soon thereafter in 1999 for Europe. Traditionally, they were used over Indices (the S&P500, DOW Jones, etc), but in 2008 were authorized over a broader scale of underlying investments.

American investors have been switching from the traditional Mutual Fund investment strategies to ETFs during the last decade. They provide greater diversification, less fees (as a listed stock you are basically just paying brokerage!), and the ability to buy and sell as you please. This greater flexibility means you can take profit when you like, exit when you think the markets are going to fall, or adopt a wide variety of strategies with the use of derivatives (exchange traded options) to benefit from Time Decay or Volatility changes etc.

They are also perfect for creating a well balanced long-term investment portfolio. No longer do you need to be exposed to individual company risk, as you can gain exposure to specific Sectors, such as Finance, Energy, Basic Materials, etc.

Making money in the markets is about looking ahead to the future and strategising on managing Risk. If you were to think back to the early 1900’s, would the iPhone, Computers, the international space station or microwave cookers have been realistic?

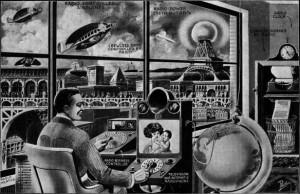

I attached the above image for a reason. This drawing is from 1922, and is an artistic view of what the 1950’s would look like. Note man is sitting at a consol that is operating (by remote control), a ship in the harbour and that he is talking on a television to his family. In the background, there is a printer or fax type machine, and he is patched into a specific point on the globe in his communications.

The reality of today’s society and technology doesn’t seem so outlandish according to this picture, but at the time, it was pure science fiction!

My belief is that ETF’s are the way of the future, from a medium to long-term investment point of view. Certainly there will always be the need to buy and sell stock, but as the world becomes smaller due to technology and international trade, the need to be able to buy and sell into those markets that are outperforming or underperforming means we need exposure to more than just country specific stocks.

If you would like to know more about Exchange Traded Funds (ETFs) or for details on some of the cheapest rates to trade internationally, feel free to contact us on brown@halifaxonline.com.au for further details.

Matthew Brown

Halifax Investment Services

ASIC Australian Financial Services License Number – 225973