China growth stalls, sending warning signals to Australian investors

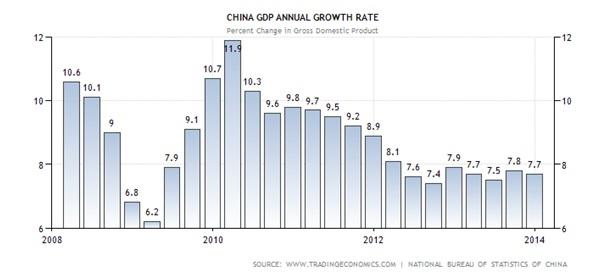

China growth stalls, sending warning signals to Australian investors: The world was notified by China on Thursday that they are expecting their GDP growth rate for 2015 to slow to 7.0% from 7.4%. Almost 40 years of exceptionally strong economic growth appears to be re-aligning itself with global growth activity. But the impact on Australia […]

China growth stalls, sending warning signals to Australian investors Read More »