Do you want to know how to bank profit, right now?

Facebook Trading Opportunity

Have you checked your social media today?

One stock I absolutely am loving this month is Facebook (NAS: FB). Not only has CEO and Founder, Mark Zuckerberg, managed to create a super addictive social media outlet. Where users can post and share moments from their life. He’s also managed to foster a whole ecosystem of business. That has made Facebook one of the largest companies on the stock market to date. From a fundamental point of view.

There’s no doubt in my mind that Facebook will become a larger part of our future lives – something we covered in our 48th episode of our Money and Investing podcast. By using what we call the “Top-Down Approach”. Seeing Facebook for what it is. It’s a business I see becoming more prevalent in society than less as it continues to expand its operations across various units. Analysing Facebook from a technical point of view. This is a stock with extremely high earnings growth yet a modest valuation. This means as a trader, you can have all the benefits of a momentum play. And Backed by their high future earnings without the downside of a stretched Price-to-earnings (PE) ratio. Which we typically see in other high growth, tech stocks.

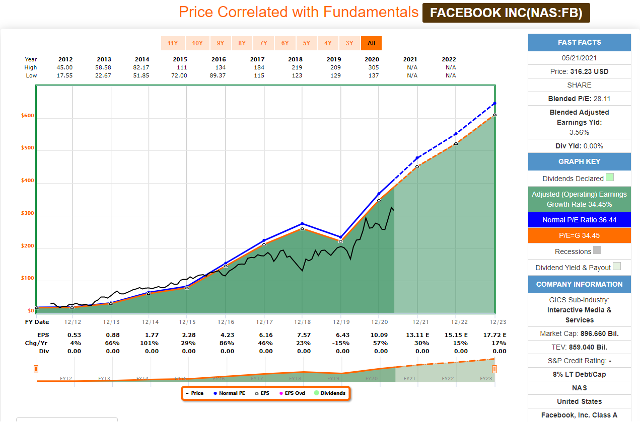

Looking at the chart above which correlates price with fundamentals. We can see Facebooks share price (the black line). Is trading below its normal PE (the blue line). And its growth PE (the orange line) by quite a bit in what would appear to be a pretty smooth up-trend. With smoothly adjusted earnings to the upside. And what this means is that Facebook is trading below. Its fair value based on its future earnings – which are expected to remain extremely high based on the fact. That it has an adjusted earnings rate of a whopping 34.45%.

In terms of valuation, we can see that Facebook has a fair value price of $390 in what would appear to be a 19% discount from where the stock is trading right now. With a 4/5-star rating on Morningstar, we know that Facebook is an under-valued stock based on traditional PE valuation – a rarity for a high-growth tech stock compared to the likes of Amazon, Google, or Netflix for example. Trading Facebook with an income-based strategy such as “Cash Flow on Demand” is something I have been focusing on this month in my trading given I can generate an up-front. Immediate income on the stock. Just like our traders of the month. I too have seen some great results in my trading particularly when finding stocks with a strong fundamental case. Behind them who are also backed by high earnings growth.

To learn more, come and check out one of our online workshops through the following link: Cashflow On Demand Online Workshop