Let’s face it – every stock market investor loves a half-yearly report and they sure as hell love a good dividend. In the case of the big four banks on the ASX – ANZ, NAB, Westpac, and Commonwealth – October is the month where all of this information is started to be presented to investors. Fundamentally speaking, there is a lot of good news pushing a positive case for the banks in what is a record low-interest-rate environment encouraging obscene amounts of borrowing, a runaway property market, and what has been arguably the fastest recovery in economic growth in history. As ‘cyclical’ type businesses, meaning their performance is tied to that of the economy, the banks have the wind in their sail to report some stellar earnings as they typically will always do in late October.

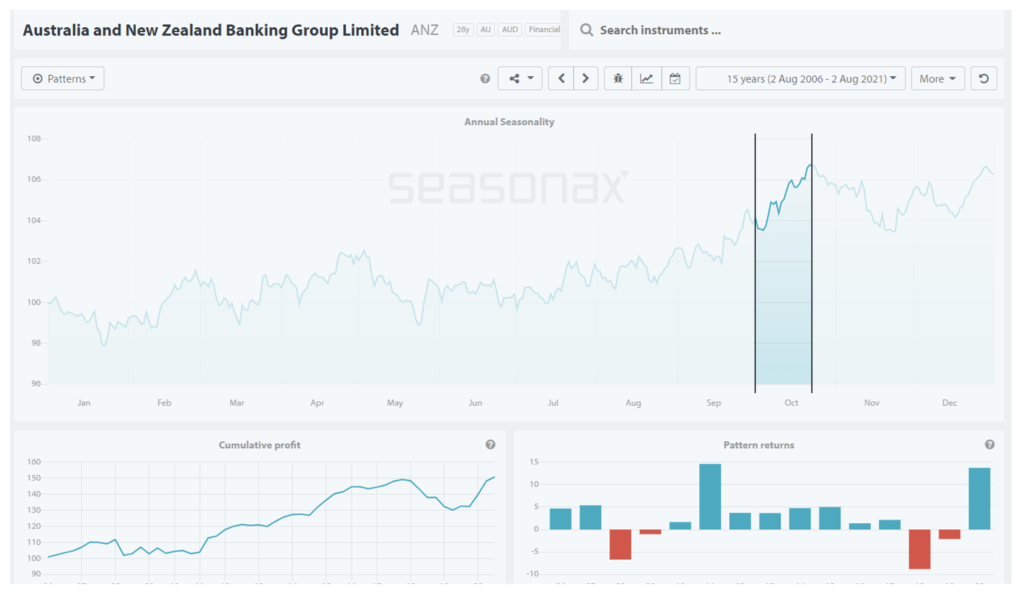

Let’s look at some specific examples to show just how obvious this trend is and how you too can get some exposure to what I suspect to be a strong run-up from early October. First, looking at ANZ – they are due to report their full-year results on the 28th of October to which they’re also due to go ‘ex-dividend’ in early November on the 11th. This is mostly the same each and every year and so we look at the seasonal chart of ANZ over the last 15 years as below, it’s easy to see where the stock is expected to be trading based on historical data over that timeframe.

Taking a deeper look at the seasonal stats to left hand side, ANZ has traded higher over 73% of the time during this period on average with an annualized return of a whopping 54.4%. Another example is National Australia Bank which is set to announce their full-year results on the 9th of November go ‘ex dividend’ on the 15th. If we look at the chart of NAB over the same time frame as below, we have much the same price pattern over the October month with pretty much identical profit and winning trades statistics.

Would it be safe to say that the banks run up into the lead-up of their earnings and dividend announcements? Well, based on my fundamental and seasonal analysis that would most certainly reign true and it has over the last 15 years.

As a professional trader like myself, I’d be looking to position myself in early October by buying the banks or Aussie bank Exchange Traded Fund such as MVB to gain exposure to the expected price increase before the tailwind starts to pick up. For an exit, based on seasonals, I’d be looking to close out and take profit between the 20th – 25th of October as that is where we typically see these stocks start to run out of steam. Back in early March we actually covered this in my Money and Investing podcast in Episode 9 chatting about the opportunity the banks present throughout the year – go and check it out if you’re serious about actioning a trade like this. To learn how to complete your own analysis on a myriad of stocks, not just the banks, jump into one of my Cash Flow on Demand webinars at the following link: Cashflow on Demand Workshop