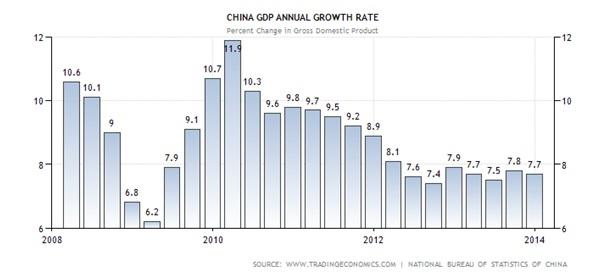

China has slowed, but the world is not coming to an end. GDP (Growth Domestic Product) figures released on Monday. And point to continue stabilization of Chinese economic growth. There are fears that the world’s second-largest economy was poise to decline even further from its 3-year GDP peak at 11.9%. But throughout 2013. Annualized GDP growth has stabilized at long-term lows.

The following chart from tradingeconomics.com depicts the annual GDP growth rate for China. At the bottom of the GFC. Global Financial Crisis, Chinese economic growth had fallen as low as 6.2%. This is a far cry from the peak of 13% in 2007.

GDP is defined as the monetary value of all finished goods and services produced by a country. Within a specific time period. Although there are numerous components in defining a Recession. An economy is considered to be in a Recession if it has two consecutive declining quarters of GDP. For China, this recent report is the first decline in this series.

Following this, the Chinese central bank announced it would inject short-term liquidity into commercial banks. Capping money market rates. The timely injection is ahead of the Chinese New Year. When people withdraw cash for travel and shopping.

There is currently tight liquidity between banks. As evidenced by a sharp increase in the 7-day repo rate (aka Repurchase Agreement – the rate of return that can be earned simultaneously selling bond futures or forward contract. And then buying an actual bond. Of an equal amount in cash). To 6.59% from 4% earlier this month.

Despite a mild knee-jerk reaction in the markets. Analysts are quietly confident that the Chinese economic growth, Is being managed efficiently. And that continued consolidation at these levels. Improves the probability for growth in the future.

Unless we see Chinese economic growth cracking below 7%. There’s no immediate need for the Australian economy to panic. It’s business as usual. Even though our mining sector has slowed mildly.

Matthew Brown – US Stocks & Options specialist

US Equity & Option Client Advisor

Halifax Investment Services

ASIC Australian Financial Services License Number – 225973

If you would like to learn more about the strategies you can use to profit from any type of market direction. Visit www.australianinvestmenteducation.com.au or you can contact Matthew on brown@halifaxonline.com.au

Matthew is a Representative of Halifax Investment Services (Halifax). Halifax provides broker services. Including Full Service and Discount Services using multiple trading platforms. For Discount platform services

Halifax charges the same fees for phone service as the online trading platform.