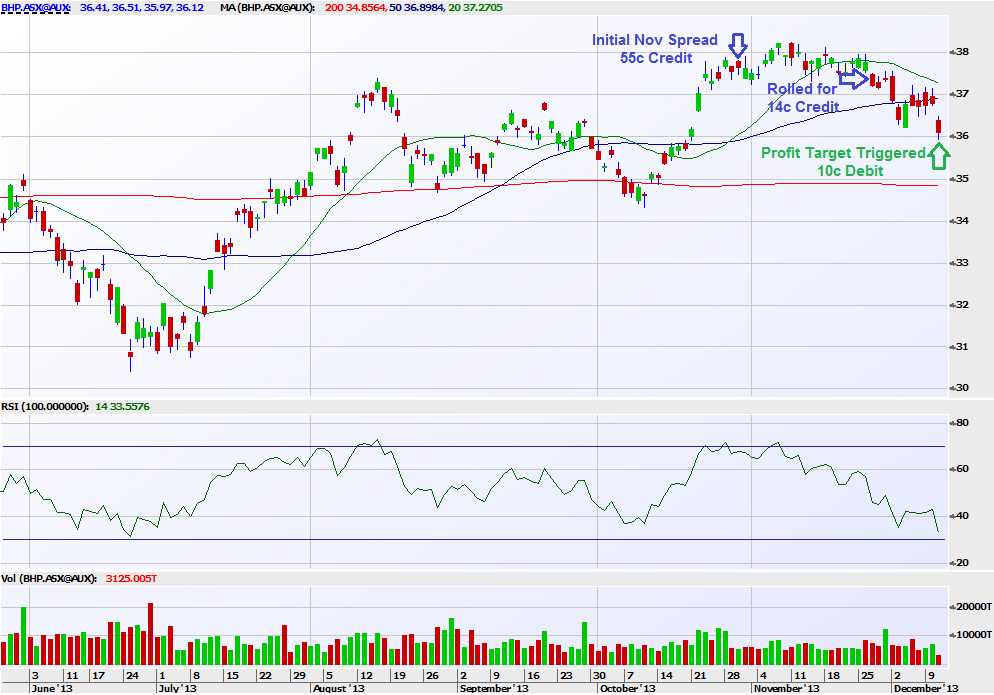

Over the last two months, we have had several successful bearish pays on BHP Billiton (ASX:BHP). Including yesterday’s exit of the Dec 37 / 38 Bear Call Spread (11/12/13). This trade was actually rolled over at the last options expiration, where we had previously held a November 37 / 38 Bear Call. For the initial November trade we had received 55c credit.

BHP Billiton Trade Recommendation (ASX:BHP) Entry Video

[jw_player file=”http://68ae6e408499dfc2c6e1-40cecf3cbedb61f0342f8d4c5cb58fad.r33.cf1.rackcdn.com/BHP_BearCall_301013.mp4″ image=”http://68ae6e408499dfc2c6e1-40cecf3cbedb61f0342f8d4c5cb58fad.r33.cf1.rackcdn.com/BHP_BearCall_301013.png” height=”330″ width=”590″ autoplay=”false”]

Click Here To Receive Free Trade Recommendations

Rolling the trade flat, and out to the December spread provided a small 14c credit. This action was taken in order to extend the time available for BHP to decline toward our target price in the low $36 levels. After a mostly sideway’s November, BHP has seen increased selling pressure this month, confirming our short-term outlook for the shares.

Overall for the two months in the trade, the total credits received were 69c. Yesterday we bought back the spread 8 days prior to options expiration for 10c, securing a gross profit of 59c per share and removing the risk of BHP rebounding over the next week. The original capital outlay that was required in order to enter this trade was 45c per share, meaning the gross return on invested capital was 131%.