To participate in the Butterfly Strategy Register Here

“Does the flap of a butterfly’s wings in brazil set off a tornado in Texas?” Edward Lorenz.

The Butterfly Effect – A Play on Earnings Announcements: In Chaos Theory, the butterfly effect is a term used to describe. How small changes to a seemingly unrelated thing or condition can affect large, complex systems. This phrase refers to the idea that a butterfly’s wings might create tiny changes in the atmosphere that may ultimately alter the path of a tornado, or delay. Accelerate or even prevent the occurrence of a tornado in another location.

In Addition, The Butterfly Spread strategy is a neutral outlook where both a bull and bear spread are combining. These positions have Risk that is limited to the amount of capital invested into the trade. While returns are capped and achieved with the position expiring with the share price at the sold strike level.

The Butterfly Effect

We have named our approach to using the Butterfly Spread strategy “The Butterfly Effect” due to the connection of a specific event and the causal reaction that occurs following the passing of this event. As we cannot predict what a share price will do once these specific events occur. We can identify the common occurrence of specific conditions that change. Such as Time Decay and changes in Implied Volatility.

Using an approach where we identify excessive option pricing situations. We believe there is a statistical advantage in adopting this strategy. Where our trade position will profit from declining Implied Volatility and Time Decay. The strategy has pre-determined Risk (the amount of capital used on the trade). Allowing for money management processes to be adopted for an investor’s portfolio/trading account.

Why use the Butterfly Spread strategy?

The traditional method of using this strategy is to implement when the trader expects the share price to remain within a certain price range. Closing at or as near to the sold leg of the strategy on expiration of the option contracts. The probability of getting this absolutely correct. That is choosing what price the underlying will be trading at on a set date in the future. Is an exceptionally low probability situation. In fact, you would have to be Nostradamus to consistently get this correct. Hence, it is a strategy that is more suited for experienced traders.

However, what we have identified is that leading into the event of a company’s earnings announcement. Implied Volatility increases. That is uncertainty as to what the company will report and how the stock market will react to increases. Once the event occurs. This uncertainty dissipates. That is Implied Volatility decreases.

High Implied Volatility

By identifying stocks that have high Implied Volatility (IV). There is a strong probability that once the event occurs. The IV will decrease no matter how the share price reacts (up, down or sideways). The value of the Butterfly position will improve with a decrease in IV. All other factors remaining equal.

The key to how we manage the Butterfly Effect strategy is that we are not attempting to make the maximum potential gain by having the position trading at an exact price at expiry of the options. Our management approach is to establish a profit taking level. Usually a minimum of 50% of the expected maximum return. Closing the position as early as possible following the earnings announcement.

Using this approach. We have identified that with a stock that has a very high IV ahead of earnings. And by targeting a minimum of 50% of the maximum potential return. There is a good probability that we can close the position positively as long as the share price does not gap outside the Butterfly spread following the earnings announcement.

Simplifying the approach and finding an edge

Rather than implementing the Butterfly spread strategy and ‘predicting’ that the share price will be trading at a set price on a set date in the future. The Butterfly Effect approach has been developed from experience in trading stocks. Around their earnings report announcement. And with an understanding of advanced option pricing techniques.

Furthermore, What we have identified is that stocks that have extremely high IV leading into an earnings event. Have a strong opportunity of an IV crush – that is, a decline in IV once the announcement has been made. And the market has more certainty on how to react to the news.

Money Management

As with all strategies, the set-up of a position is not the only important factor. Money Management is exceptionally important. And hence we have stringent rules to take profit early and to cut losses where ever possible. In the end, however, each trade should only adopt if the trader is willing to Risk the amount of capital on the trade. The maximum loss is 100% of the position.

The Risk of the earnings announcement is that the share price gaps exceptionally after the event. This normally occurs if the company provides results that exceed or disappoint. Surprising the market and missing expectations. Should the share price gap too far. The maximum loss will achieve. Hence, the selection of the position strike levels needs to consider. What should considered an ‘acceptable’ level for the share price to gap.

Get Involved

If you would like to get more information about this strategy please Click Here

Trade Examples*

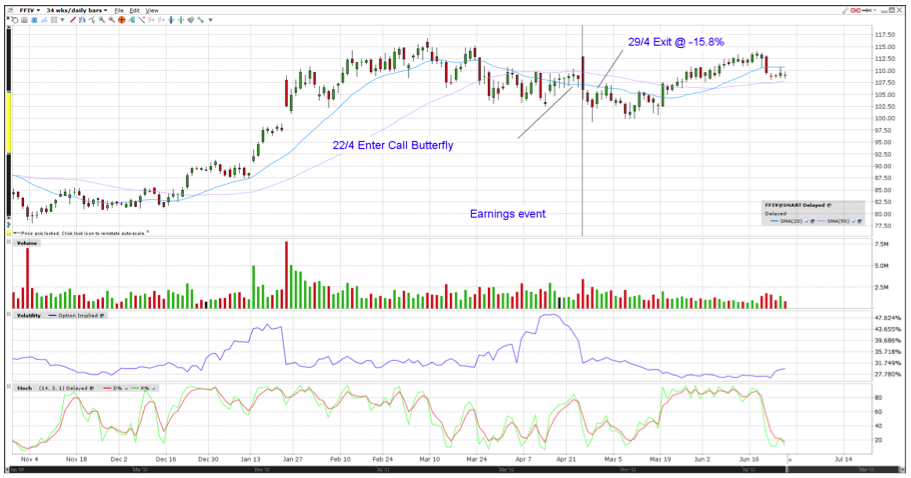

In the following examples for Q1 2014, we have highlighted Butterfly spread positions we have traded between 15 April & 5 May, noting the entry, earnings event, and closing points. All results are quoted as Gross figures.

* Customer Caution Notice: Results are quoted in a gross percentage (not inclusive of brokerage fees). The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect its future performance. The return mentioned above does not include fees or charges. Which may vary in any trading scenario. And Assessing the suitability of this product should not be based solely on this information.

Get Involved

If you would like to get more information about this strategy please Click Here