Have you ever wondered how much money you will need to have for you to have a comfortable lifestyle when you retire?

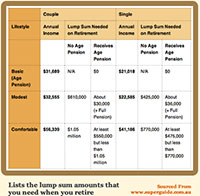

A great question and one which prompts such a wide variety of responses, depending upon who you ask! The other day, I read an article that suggested that the average Australian couple. Would need about $1.05 million to live comfortably on $56,339 a year after retirement. I don’t mean to scare you but how close to that are you? And that is without the Government dipping in for another slice!

So what can be done to either create this lump sum nest egg, or get the nest egg you have got, working more effectively?

So what can be done to either create this lump sum nest egg, or get the nest egg you have got, working more effectively?

Many investors jump into the stock market – and very quickly realise that it can be a dangerous place for those without the right knowledge and skills. Afterall, we have all heard the horror stories. From those that had the courage to at least give it a go. What’s more, it is not simply the retail investors who perhaps went backwards – even some of the big players made investments that produced low. If not negative returns for their clients.

Part of the reason for this comes down to how the majority of investment strategies work.

In a nutshell, they rely on correctly guessing the direction of the stock, in order to get paid. I am not sure about you. But I would hate for my retirement strategy to be based on “red or black”! Getting the direction right is 50/50 you are either right or wrong and get paid accordingly. What can we do to improve our odds of success?

Firstly, how about a strategy that you get paid first, up front, right off the bat each and every trade? I am guessing that this would appeal – that is, money in the bank, up front. From here, what to do next – wait, and let time pass by – why? Because this is also a largely passive strategy – requiring a handful of minutes to fully manage each month.

The difference here – between this and many of the more widely marketed strategies out there. Is that we are not looking to speculate on the market – we are effectively creating the market. What I mean by this, is that we are not looking to buy options – which are wasting assets and must perform within a given time frame – instead, by writing calls. We are creating the market and getting paid, in the process.

This is a strategy which over time, is shown to outperform. Check out the chart below and you will see for yourself how this strategy has outperformed the ASX 200.

In addition and to give greater flexibility for investors to tap into a truly diversified cash flow base. This strategy is used on both the Australian and the US markets – providing an almost endless supply of opportunities. When used in conjunction. These markets provide significant advantages than when used alone, and ultimately. The business of profitable trading and investing is all about taking steps to improve your probability of success by capitalising on these sorts of value add.

MY big question to you, is why not become even more educated?

While almost everyone is making their lucky guesses and making bets. A handful of “educated traders and investors” are sitting on the other side collecting premiums by trading options. And applying tried and tested strategies that have the potential to make regular monthly returns. While the less educated people are taking the big risks.

Obviously, in this case “education” is a serious advantage to have. That’s why most of the “educated” investors want to keep this information to themselves.

I am totally passionate about sharing this strategy with you – and I am going to give you the opportunity. To join me for a 2 hour workshop. Packed full of education and strategy, totally free of charge. Click Here to Register

Why wouldn’t you – afterall – there is no cost, I will reveal the trades we are working in right now in the market and the income our clients are earning. Click Here to Register