Shoulda, coulda, woulda! Over the last decade, I’ve had hundreds of conversations with traders and investors. Who have told me how they had picked a “million dollar trade”. But failed to profit for one reason or another. If only they could have gone back in time and executed the order properly. Or held the trade that little bit longer, or put more money down to make a squillion.

Shoulda, coulda, woulda! Over the last decade, I’ve had hundreds of conversations with traders and investors. Who have told me how they had picked a “million dollar trade”. But failed to profit for one reason or another. If only they could have gone back in time and executed the order properly. Or held the trade that little bit longer, or put more money down to make a squillion.

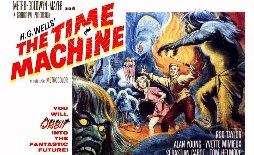

In science fiction movies over the last 60 years there have been numerous references to time travel. From HG Wells “The Time Machine”, Charles Dickens “A Christmas Carol”, to Superman, Star Trek, and the Back to the Future trilogy. The concept of time travel has caused an endless number of people to day dream about what could have been.

Reality is that most of us know Time Travel (or at least 98% of us do), is a pipe dream conjured up by those talented artists who make movies that fuel our dreams. But even Albert Einstein proved that time is relative, and not absolute as Isaac Newton had claimed. So the smartest of us all failed to agree on the concept of Time Travel.

Even so, if I were to wave my magic wand and were able to travel in time, I would certainly like to look ahead to what will make me a profit in the months and years ahead. So let’s stare into the traders crystal ball, shake the magic eight ball and consider what we will be talking about in 6-months time.

- Continued sovereign debt issues in Europe

We can’t see much of a future for Europe at this stage. They have been throwing funding at the PIIGS to ensure the broader EU doesn’t fall into a Depression (it is widely accepted that half the EU is currently in a Recession).

This means further negativity in the stock market. So don’t expect strong bullish activity any time soon. This week, the European Union slashed its growth forecast for 2013. It now expects output in the 17 euro-zone countries to expand by an average of just 0.1%, down from its previous forecast of 1% in May. Germany’s economy is predict to grow by 0.8%, whereas Spain’s is expect to contract by 1.4% and Italy’s by 0.5%.

- Australia’s economy continues to consolidate

Our economic growth relies on the broader global picture. In particular, China. Although our major trade partner has weakened in the last 2 years, it is still growing. Our major miners can see the writing on the wall and have consolidated their expenditure. Australia’s central bank kept its main interest rate on hold at 3.25%. A cut of around 25 basis points is widely expect sometime before the end of 2012 because of concerns that the slowdown in commodity prices will hurt growth.

- US economy on the brink of contraction

The “Fiscal Cliff” scenario where tax rebates are remove and government budget cuts is due on the 1st of January. If it is not address by the government, then this will send the US economy into a Recession.

With Barack Obama re-elected as America’s president, beating Mitt Romney by around 50%-48%, there is potential this could be a political nightmare in getting a resolution (much in the same fashion raising the debt ceiling late 2011 cause the markets to panic).

Our view is there will be some panic in the markets until a resolution is announce. But the longer-term outlook is for continued weakness/consolidation for the US economy as high unemployment will take time to decrease. In addition to this, the first term of a President’s tenure is usually weak for the markets and the economy.

- China’s economy will consolidate and start to show an improvement in growth

The 18th Chinese Communist Party congress opened in Beijing. Hu Jintao, who is stepping down as party chief, admitted in his state-of-the-nation speech that China’s development is “unbalanced, uncoordinated and unsustainable”, but did not put forward any plans for deep political reform.

With a new leadership and as the world continues to consolidate, China will start to show signs of improvement. The world will hinge on the strength of China, so the sooner it improves the sooner the world will recover.

Bottom line is that two key global regions are facing drastic hardships: Europe & the US. Government debt, high unemployment, and slow growth prospects mean we need to be looking elsewhere for long-term investment.

Australia is a neutral economy catch between East and West. Our future fortune is based on Mining, and the miners are battening down the hatches for the next 12 to 18-months. Although we may not fall into a Recession, stock market growth will be limited.