1045 Pips of profit – so when the RBA meets to discuss interest rates…Most people – those with a mortgage – swiftly calculate that this means a few dollars saved off their monthly repayments. This always reminds me of the expression that a saving is as good as a profit!

However, saving a few bucks here and there pales into insignificance. Compared with the real opportunities that are there. Around interest rate announcements, and they are in the Forex market.

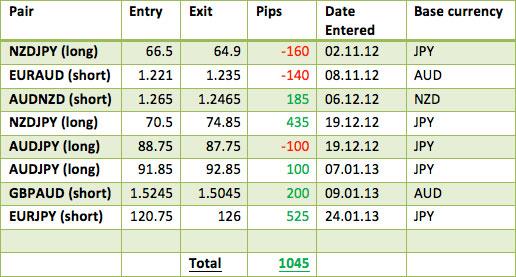

Here are some examples of Forex trading, over recent weeks.

Please be aware that all trading activity is subject to both profit & loss and may not be suitable for you. Past performance is no guarantee or reliable indication of future results. The above results are hypothetical and do not include transactional fees and slippage and are based on recommended trades.

Please be aware that all trading activity is subject to both profit & loss and may not be suitable for you. Past performance is no guarantee or reliable indication of future results. The above results are hypothetical and do not include transactional fees and slippage and are based on recommended trades.

With Europe’s debt crisis beginning to re-emerge in the headlines. You can be confident in a return of volatility to the market. And this, of course, means opportunity. If you have the right strategy. A loss of confidence in Europe’s ability. To manage itself out of the doldrums would likely see Euro weakness (the Euro has drawn less attention than the US dollar over recent weeks). Add to this, Germany’s upcoming elections in September. In order to have a stronger chance of re-election, Chancellor Merkel will almost certainly have to become more focussed on Germany’s needs, rather than those of the inextricably linked Euro Zone. This again undermines confidence in the Euro.

Elsewhere, in Japan, ongoing currency intervention from the Japanese Ministry of Finance has seen the market ease into low levels that are creating tensions with Japan’s trading partners. Car manufacturers in both Europe and the US are finding the new price competition from Japanese producers hard to swallow, with imported prices significantly reduced. Intervention can of course, be a useful ally for the savvy currency trader, effectively providing a “rich uncle” to underwrite trends. The Swiss Central Bank has been equally as active in this space, looking to keep their Franc pegged to the Euro.

Unfortunately, many investors miss out on trading these markets, through a lack of confidence, knowledge, strategy or skills. Add to that, the 24 hour nature of the market, and it can sometimes seem “all too hard”. For those who are interested in accessing these markets in a more “hands off” way, let us know, as we have a variety of services which may be of assistance. Click here to register your interest