There’s a concept amongst professional investors that the US markets decline in May and throughout the US Summer period are deflated, in comparison to the remainder of the year. This has spawned the catch cry “Sell in May and Go Away”, which we believe is shaping up to come true again this year.

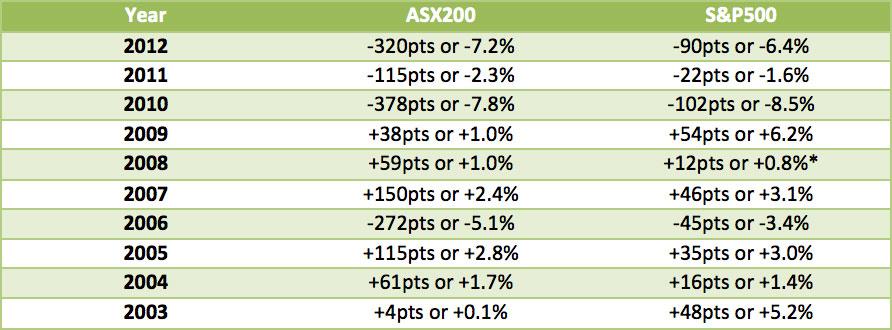

But firstly, let’s take a look at the statistics over the last 10 years for the ASX200 and S&P500 for the month of May:

*Final upwards month ahead of a 47% market decline – the GFC (Global Financial Crisis)

For the ASX200 index, there were 4 negative May months, and 6 positive May months. The average negative month was 5.6%, whereas the average positive month was 1.5%. For the US S&P500 index, there were also 4 positive and 6 negative months for May, with the average negative month coming in at 4.9% and the average positive month at 3.15%.

Analysis of the last 10 years of trading doesn’t suggest. It is more probable for a downwards month. But if sellers do enter the markets at that time. It has a higher probability of being a strong downwards month.

We need to consider the broader economics at the same time. From 2003 through to 2007. The markets were in a strongly expanding economy. This provided a background of positive growth prospects. Compared to the 2007 to 2009 period which was the second largest market crash in history. And then a range bound stock market from 2009 through to the present.

History has proven that most of the major market crashes have occurred in the September/October period – 1929; 1987; 2008 for example. And stock market crashes usually occur after a reasonable decline prior to the news headlines. This supports the Sell in May outlook as a leading indicator to a weaker period later in the year.

Currently, both the US and Australian stock markets are trading at or near long-term highs. Year to date, the ASX200 index is up 333points or 7.1% while the S&P500 index is up 113points or 7.8%. Double those figures and you have the approximate gain since the lows in November/December.

Our view is that although this strong Bullish run has set 2013 up to be a positive year, this type of stock market growth is not sustainable through to the end of December. Could you imagine the markets gaining 7% per quarter to finish up 28% for the year? We just don’t see this economic environment as being strong enough to sustain that growth.

This means there is going to be a market correction or consolidation. Could it be in May? There’s no evidence to suggest that May is a stronger probability than any other month. However, we certainly do expect the middle of the year to provide us with a contraction against the broader upwards trend.

Investors should maintain a bullish outlook for 2013. But be aware of their ‘timing’ of entry and exit orders based around this expectation. And although we can’t predict what the markets will do this month, or next month, or the month after. We certainly can adopt strategies to reduce Risk exposure or protect our positions if we in fact do have the signals to define a downwards trend starting in May. Should we “Sell in May and Go Away”? Certainly … but only if the signals of a bear market are provided.