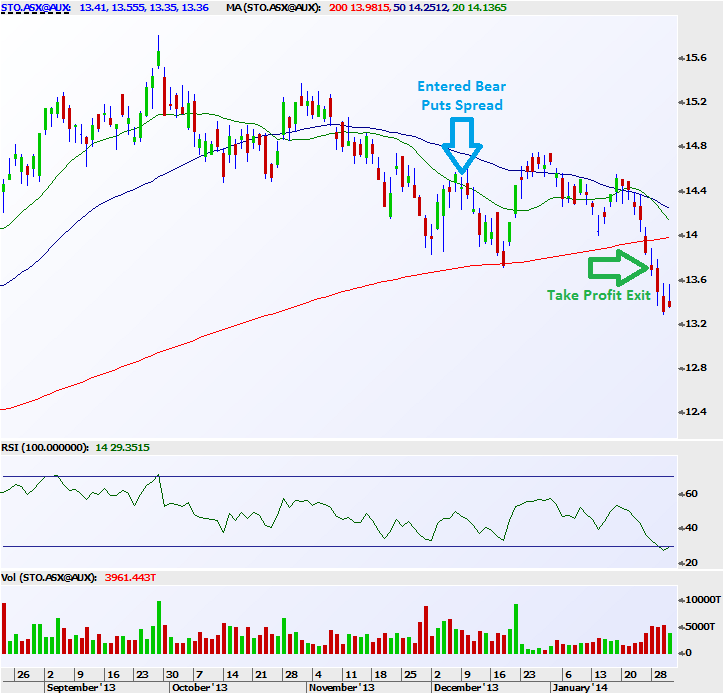

This week’s close trade of the week. Is our Bear Put Debit spread on Santos Limit. And this trade was initially open on 9th December. And due to changing trend conditions that signalled potential for further downside in STO’s stock price.

Click Here To Receive Free Trade Recommendations

We entered this trade on 9t December by buying the Jan 14.50 Puts and selling the Jan 14.00 Puts for a combination spread price of 20.5c per share debit. As a debit spread. Our risk is a cap at the premium paid. While our upside is a cap at 29.5c max gross profit.

After entry, the stock varied between supports around $13.80 and resistance levels near 14.50, mostly adhering to the outlook on the trade. Coming into options expiration this week, we were able to close the trade at 46c, locking in 25.5c gross profit (+124.4%) whilst removing the risk of STO rebounding back higher again prior to options expiry.

For our Level 1 Traders (smallest risk traders). This trade equated to a gross $357 profit on the initial capital outlay of only $287.