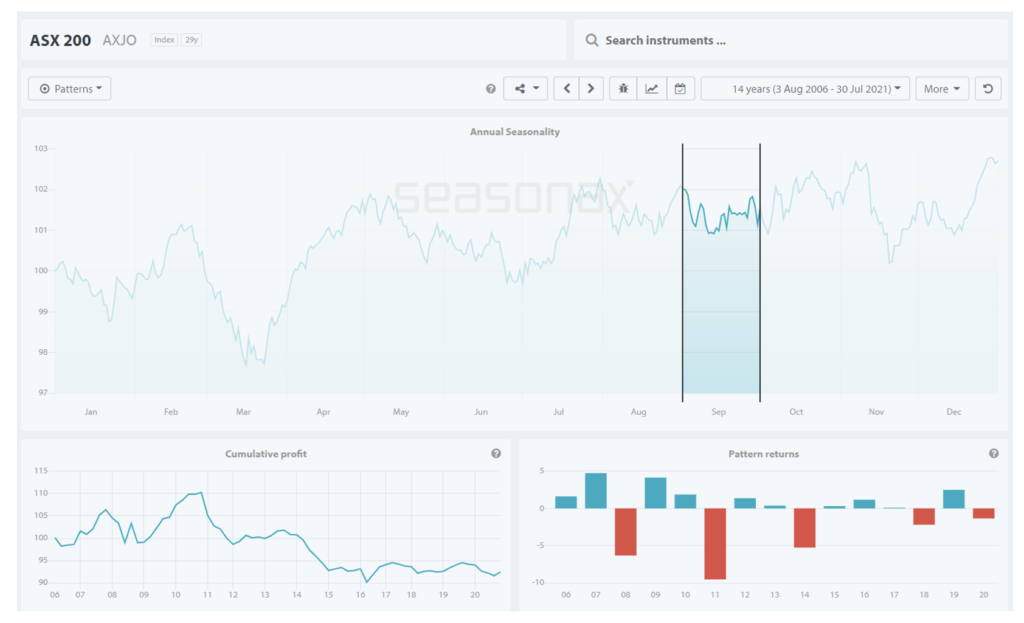

There’s no doubt we’ve had a stellar run in markets over the past year or so. In what was a major crash amidst news of the initial Corona Virus outbreak, many investors took this as an opportunity to buy up and take advantage of arguably the quickest run-up in markets ever before. With the ASX breaking that crucial level of 7500 points in early August and rallying quite hard, my suspicion is that September may not be as strong of a month and rather may be a little choppy. Why? Well, if we take a look at the seasonal statistics of September on the market as a whole, we can see that September may the month of volatility and choppiness in prices. For those who don’t quite understand what ‘seasonals’ are, this is a type of analysis that professional traders like myself use, that compiles data over certain periods of time to give a forward-looking estimation as to where we see a market (or stock) heading in the near future. Take a look at the graph below of the ASX200 index.

From the price action provided in the graph above, it’s easy to see that from the 1st of September – 1st of October, the market is typically pretty messy. Additionally, our stats on the right shows that the month of September over the last 14-years has provided an annualized return of -6.10% with only 66% of trades being winners. On average in September, the index has dropped nearly 276 points proving to be what is a wishy-washy month at best. So, if this is how we expect markets to look over the next month, how does a professional trader like myself profit from this? Well, in choppy market conditions where we typically see increased volatility, my recommendation is to play some defence.

What I mean by that exactly is taking some long positions in more defensive stocks as these are the kinds of businesses to add on legs during these volatile times. Stocks like Wesfarmers (ASX: WES), Coles (ASX: COL), Metcash (ASX: MTS) and Woolworths (ASX: WOW) are great examples of where I’ll be looking to put my dough over this period of September. As a matter of fact, we covered this in one of our Money and Investing podcast episodes last year in episode 44 where I specially spoke about defensive plays during times of high volatility and uncertainty – check it out to hear for yourself. Of course, I’ll be using a myriad of other analysis techniques like technical analysis, fundamental analysis and quantitative analysis to justify my decisions moving forward, which you too can learn how to do in one my Australian Investment Education webinars. Click the following link to learn how: Cashflow on Demand Workshop