Investing in stocks that have strong trade with China is a very sound investment decision.

You don’t need to be Einstein to realise that the massive amount of construction in China requires insurmountable amounts of raw materials, labour and skilled professionals. But for how long will this Boom last?

Riding the coat tails of this new global leader is all well and good for now, but every boom comes to an end. And we need to be aware of the signs of when to get off the gravy train.

The mining sector was the key factor for Australia riding through the GFC (Global Financial Crisis) in 2008/09. Due to the strong demand for resources from China, our economy

held strong despite a global slump. Still, the S&P ASX200 index lost 54% in value during that time.

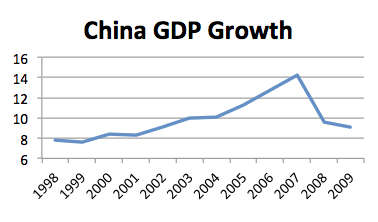

China’s growth is almost unprecedented. Before 1978, annual growth (GDP) averaged 6% per annum. However, economic reform and numerous fundamental changes to international trade and private business ownership kick-started an economic boom. China’s GDP growth over the last 30 years averages 10%, with peaks as high as 15.2% in 1980.

No economy around the world has grown at the rate that China has over the last 30 years!

China’s population is just over 1.3 billion people. This represents 20% of the world’s total number of inhabitants. The population growth experienced in China has been dramatic at the very least. In the 1950’s, the population was a mere 563 million people. The “one child policy” was introduced in 1979 and yet the 1 billion people mark was attained in the early 1980’s.

The demand for raw materials to fuel this freight train is insatiable. With unprecedented growth throughout the country, China has become the major trading partner for all leading developed countries.

The International Monetary Fund (IMF) recently announced data where they expect China’s growth will overtake the US in real economic output (as measured by GDP) by 2016. This would be, in fact, an historical event. No other country in the last century has even come close. At the height of its strength, the Soviet Union only represented one third of the US’s GDP.

A survey of global investors by Bloomberg recently found that 45% had expected a financial crisis in China within the next five years, with another 40% anticipating a crisis after 2016.

The biggest cause of this is Inflation. The Property sector has been booming at a phenomenal rate with the average housing prices tripling from 2005 to 2009. The cost of food is also outpacing wage increases, but this is actually occurring worldwide. For example, Corn is up 130% since July 2010, between June 2010 and Feb 2011 Sugar had gained 150%, while Coffee had gained 135% since June 2010. All of these price rises having occurred in less than a year!

As the population shifts from the rural setting to urbanization, and the middle class desires more household goods and services, Inflation will only continue to remain high. Just imagine taking the Australian economy from the 1920’s and dumping society directly into the 2010’s! This is what is happening almost overnight in China.

Efforts by the government to slow rising house prices include the following solutions: a property tax on two of the biggest cities (Shanghai & Chongqing) where high-end 2nd homes must pay a 0.4 to 1.2 per cent annual tax level. There is also a 60% down payment for 2nd homes and a 30% down payment for first homes, while banks have been ordered not to provide loans for third or later homes.

In addition to this, the Chinese currency is fixed to the US Dollar, compared to being a floating currency that fluctuates on its own supply and demand issues. There is much debate over the fixing of the Chinese Yuan to the US Dollar, as it undervalues the Chinese currency, giving their exports an unfair advantage by making them artificially cheaper than international goods. The impact for Australia is our goods cost the Chinese more, but Chinese goods cost us less. Hence, our major trade with China is raw materials rather than manufactured goods or services.

Comparing Apples with Apples …

We have recently seen the decline of one of the world’s leading Asian countries – Japan. Following WWII, Japan became the world’s technological hub. With military efficiency in their manufacturing and without the cost of supporting a Defence budget, Japan was able to create the 2nd largest economy within 50 years. Surpassing the former Soviet Union and second only to the United States.

Economic reforms for China began in the 1970’s, and in less than 40 years they have taken over Japan as the 2nd largest economy, and are on the verge of surpassing the US. But will they suffer the same fate as Japan?

While the rest of the western world suffered from the impacts of the GFC, China bucked the trend and forged forward. Improvements in productivity stemmed from capital investment into infrastructure, education and technology.

As a Socialist state, China and the former Soviet Union had many things in common, such as extensive government controls and an economy where labor was concentrated in agriculture and prices were fixed by the state.

But the USSR collapsed whereas China has excelled!

China has successfully converted its labor force from agricultural to manufacturing. Prior to 1978, 4 out of 5 Chinese worked in agriculture, whereas by 1994, only one in two did. In addition to this, China opened up its economy by expanding property rights and relinquishing control over the rural sector. Prices, although still somewhat fixed, became freer, providing incentive for improved production.

The status of China in the modern world is not likely to see a collapse such that the Soviet Union had experienced, anytime in the near future. But that does not mean a financial implosion such as that experienced in Japan or even the US could not occur. It’s just that the likelihood of this occurring during such a phenomenal growth period is very low indeed.

Inflation remains the key. As the country continues to grow and expand, the key areas of concern that should be on your radar are:

- Rising commodity prices,

- Energy prices, and

- Rising labor costs

Chinese inflation has been held (on average) at 4.25% from 1994 through to 2010. Earlier this year, inflation jumped to 5.4% for the quarter ending March 2011, which reiterates the concerns

But what are the impacts of this phenomenal rate of economic growth?

All Booms eventually bust. As history has proven, when economies excel, inflation takes over and it will self implode. This is the greatest concern for the still socialist Chinese government – to contain inflation but maintain economic growth.

The Risks for China include:

- Producing more natural resources from within the country, decreasing the need for imports

- Purchasing/investing in international mining ventures for exports to China. This too will reduce the demand for Australian resources

- An economic slowdown where demand for natural resources will decrease. This is most likely to stem from rising Inflation.

China is increasing their mining of natural resources, which will ultimately lead to a decrease in their imports. That is, they’ll buy less from us. This is a prudent move from China as high commodity prices are fuelling their inflation. However, a slowing in their economy would lead to lower imports of natural resources, with Australia likely to suffer directly.

At the same time, Chinese mineral companies are investing offshore into projects and mines around the world and it is estimated that future imports of commodities will be from companies that are partly owned by the Chinese.

Is China winning the Inflation battle?

The battle against Inflation has an uncertain future. Recent increases to Interest Rates is certainly helping to slow manufacturing, but the exorbitant prices for property is causing a massive divide between the “haves” and “have nots”. In addition to this, the general cost of living is certainly accelerating with higher fuel costs and in the cost of food.

Although economic growth slowed in the first quarter for 2011, inflation has accelerated to a 3-month high of 5.4% (as previously mentioned). The People’s Bank of China (PBC) wants to maintain inflation below 4%, so this will mean more increases to Interest Rates on the short-term. As GDP has remained strong, this should actually be absorbed quite well into the economy, but the long-term outlook still warrants concern for Inflation.

With regards to Australia’s natural resources, China has bought more and more of what we sell, principally coal, coking coal and iron ore. However, they are increasing the amount of LNG contracts as massive expansions in QLD and WA increase our production potential.

China has, however, become a net exporter of seaborne coking coal for the first time since the global financial crisis (late 2008), as prices of the steelmaking fuel surge in the wake of the Queensland floods, causing the Chinese to curb their steel production.

Coking coal prices at Queensland ports have shot up from about $US200 a tonne before heavy rains hit the world’s biggest coking coal exporting region over summer to about $US330 ($307) a tonne now. Chinese mills cut back on steel production to curb falling prices. However, this should improve as the state recovers from the natural disasters.

Australian exports to China, which skyrocketed from $5.4 billion in 2001 to $60.9 billion in 2010. China spent almost $80 billion on ore in 2010, and almost 40 percent of that came from Australia. Iron ore comprised about half of Australia’s total exports to China. They’re buying up as much as we can offer, but how long will this last?

Opportunities continue to exist

Exposure to the China Boom can be gained through a couple of different methods which include:

1) Investing in stocks that have contracts to export Minerals such as Coal, Coking Coal, Iron Ore and LNG, or

2) To invest in stocks that Chinese companies have partnered with or have invested in

So where to invest? The following table outlines a small group of those companies that may have potential for future investment. We recommend contacting your advisor to discuss their current stock price and investment potential

*Stocks are in no particular order – listed alphabetically

| Code | Company | Chinese Interests | Minerals |

| AQA | Aquila Resources | 15% owned by Baosteel Group | Coal & Coking Coal |

| CYU | China Yunnan Copper | 21% owned by ChinaYunnan Copper – a subsidiary of Yunnan Copper Industry Group – China’s 3rd largest copper producer, and their largest silver and bismuth producer. | Copper |

| EXE | Exoma Energy | China National Offshore Oil Corp (CNOOC) to buy 50% stake | Coal Seam Gas |

| GBG | Gindalbie Metals | 50/50 JV with Ansteel who has a 30% ownership | Iron Ore |

| LNG | Liquefied Natural Gas | Sold 20% stake to China National Petroleum Corp | Coal Seam Gas |

| LYC | Lynas Corp | In direct competition with China (who controls 95% of the market) | Rare earth minerals |

| MGX | Mount Gibson Iron | APAC Resources owns approx 7% | Iron Ore |

| MLX | Metals X Limited | 29% owned by APAC Resources, and 13% by Jinchuan | Tin, Nickel, Gold, Copper, Zinc, Phosphate, Uranium, Lead and Tungsten |

| MMX | Murchison Metals | 50% partner with Japanese developer Mitsubishi Corp, who are in discussions with Chinese investors | Iron Ore |

| ORG | Origin Energy | Sinopec has 15% stake in QLD LNG JV | LNG, Coal Seam Gas & Renewable Energy |

| RIO | Rio Tinto Ltd | 40% owner of Channar Iron Ore mine by China Iron & Steel | All metals and mineral mining and production |