The future of Apple Stock. Apple’s announcement of a share buy back of biblical proportion suggests that within the company, the view is strong and they are backing themselves. The increased in dividend also comes as a small reward to the stock holders who have endured a tough time.

In terms of guidance, sales have slowed and margins have been squeezed – both by lower margin products (such as iPad Mini) and new markets, particularly the East. We discussed this on 25th January, in our article Apple Crumble

As Apple comes to terms, by virtue of its size, to being managed more like a traditional business, it will be very closely scrutinised to see if balance sheet management also impacts on creativity. With new products in the pipeline, but not for release in the current quarter, expectation management, as well as the restructuring will be a major task for management.

What’s the Future of Apple Stock (AAPL)?

What’s the Future of Apple Stock (AAPL)?

We remain bullish toward the stock, and at current levels and multiples, it certainly represents value by the traditional metrics. However, the risks on the trade come in two forms – one internal, one external.

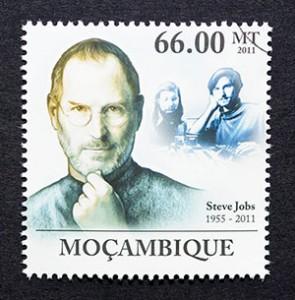

Internally – the ongoing risk of launching a dud product. It has been a while since Apple fell foul of the keenly discerning tastes of the technology market place. In the post Jobs era, any new products will come under even greater scrutiny, looking for a stutter step without the company’s former patriarch being hands on in the development and launch process. By contrast, a smooth and clean launch of another “world-beater”, and the Apple juggernaut will continue to chug on.

Externally, Apple’s dominance of the market it created is reducing. The competition is catching up. Last night in Sydney, Samsung launched its new Galaxy, while lower cost alternatives are gaining more than a toe hold. Equally, the App market is rapidly maturing – again this has been a solid earner for Apple, so what next?

Throughout the company’s history, its uncanny ability to create and dominate its newly created markets has left the competition for Dust – at least in the short term. However, can the maverick corporate behemoth continue in that vein? Time will tell.

The next quarter, and post buy back, may prove challenging and certainly choppy. So much is riding on what is to come, in terms of new products. As such, and for those comfortable with what could prove a white knuckle ride, a longer term calendar spread may prove the way forward, limiting capital at risk as well as capitalising on any volatility spikes.