The Rise and Rise of Trading Bank stocks. As the stock market starts to show signs of topping out. We take a look at the reason behind the recent phenomenal growth on the ASX. Bank stocks have a driving force behind the recent market rise. But is there any more upside for trading bank stocks in this market?

Let’s just take stock of what the ASX200 has done in the last several months. Since a Double Bottom pattern that had formed in June 2012 at 4,000 points, the stock market has risen approximately 1,100 points (or more than 27%) as it recently peaked at 5,100.

This exceptional run from the buyers is one of the strongest performances by the market since the recovery in 2009 following the Global Financial Crisis (GFC). It also pushed the ASX200 into a new 4 and a half year high.

But what is driving this market?

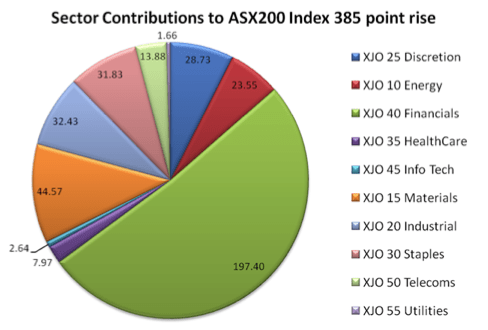

The Financials Sector has added 197 points to the rise of the ASX200 index, while the Materials has added approximately 45 points, with all other sectors contributing the remainder. As at the 18th of February, the ASX200 was up 8.27% since 2 Jan, and 4.24% of it is Banks (comprising mostly of the top 4).

Trading Bank stocks has been a real money maker for many traders over the last 6 months.

However, for most owners of ANZ, CBA, NAB and WBC, they have merely been recovering what they had lost in mid-2011.

The recent market rally is not broadly based across all sectors, with these bank stocks, a mere 4 companies of the 200 stocks that make up the ASX200 index, contributing roughly 50% of the 1,100 point rise. The following graph depicts the weighting of the 10 Industry Sectors that make up the ASX200.

At time of writing, the ASX200 has closed down 113 points to close at 4,985 on Thursday 21st February. If you were trading bank stocks, in particular the Top 4 Banks, on Thursday you would have experienced a 2.7% loss on ANZ, 2.8% loss on CBA, 3.4% loss on NAB and 2.7% loss on WBC. Again, the proportion of influence on the ASX200 is greater from the Banking sector than all other sectors put together.

One of the key reasons the Banking sector has risen so strongly is due to the fear that the Mining Boom has come to an end. China’s economy has purposely slowed down in the last two years, creating less demand for our natural resources. Clear signs of the impact in this sector is represented by the postponement of the BHP Olympic Dam project.

Consumers are also hesitant in spending money. With the savings rate increasing in 2012/13 as Australians attempt to build a financial buffer and curb their spending. The cost of living has increased with a ‘2-speed’ economy. Creating a divide between those earning higher wages (in particular from the Mining and IT sectors), and the remainder of the country.

So the bottom line is that investors are shifting money out of Cash investments and the Mining sector. And have been trading bank stocks as a means of finding higher returns in a relatively stable sector.

The strong negative reaction from investors on Thursday. Could be the pivot point for a change in trend. Or it could be a mild emotional reaction. We don’t believe this upwards shift in the markets can be sustained indefinitely. And certainly not by trading bank stocks alone. For this reason, the potential for a market pullback has increased dramatically.

But we don’t fear a market fall, as outlined in our article written in November 2011 “Why I Don’t Fear a Market Crash”. This could end up being a great opportunity to accumulate stock. We just need to patiently monitor investor reactions over the coming week. A return of buyers (forming a higher low point), would be a great opportunity to trade bank stocks. But at the same time, the next upwards leg in the markets could have us in an Overbought region. That could see the end of the broad upwards trend.

The economy is not that strong that it can sustain an exceptionally strong stock market. If the ASX200 continues being driven by bank stocks. Then the only result we can see is for a pullback through the middle of the year.

Related Article: https://australianinve.wpengine.com/investment-blog/why-i-dont-fear-a-market-crash/