Trader of the Month – July 2017: Sometimes when we reflect on life and wonder why we do what we do. It can create more questions than answers. When I read this email and nomination, not only did it put a huge smile on my face. But it also confirmed for me, why I do what I do. Getting on the next flight just got a whole lot easier, so thank you Ms D!

The back story for this month’s winner of Trader of the Month is huge. Its also very personal so I won’t share too much of it with you. But it really is a great inspiration for anyone out there who needs to create a new story to replace their current one, as to why their investing isn’t working, had a bad experience in the past or is just running out of momentum.

This lady is very quiet, extremely unassuming and had previously lost a lot of confidence through another financial educator. We have been in regular contact, she has done the work over the past 12 months, and on the 19th of February, at Deakin University, we had a very direct conversation about creating a new ending to the current story, once and for all.

They may sound like words, but they have huge meaning and even greater impact. I really cannot begin to tell you how proud I am to announce Raewyn Darlington as our Trader Of The Month for July 2017. Top Job, you beauty, Raewyn!!!

She stepped up, faced her fears and did it anyway, and that is exactly what this Award is all about. Helping to inspire our community of traders, new and old alike, to keep grinding it out and owning their future.Best case scenario here is a 7.78% profit, worst case scenario is 5.19% PROFIT

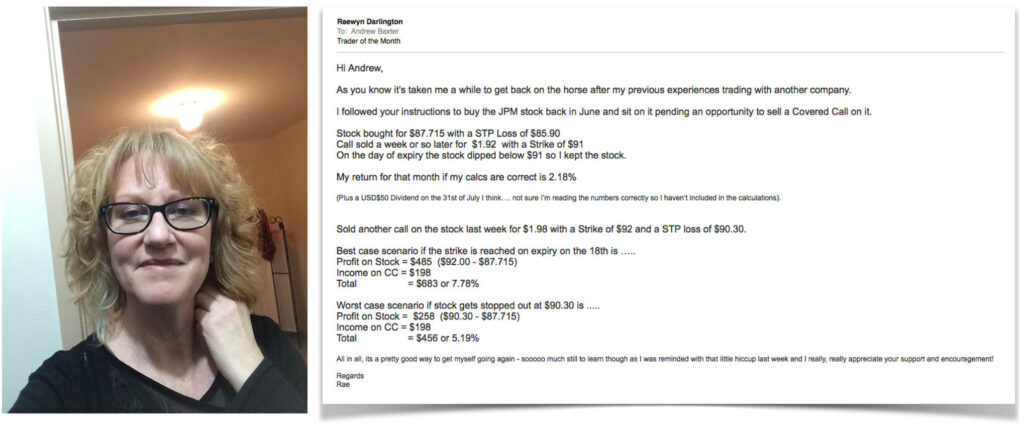

From: Raewyn Darlington

To: Andrew Baxter

Subject: Trader of Month

Hi Andrew,

As you know its taken me a while to get back on the horse after my previous experiences trading with another company.

I followed your instructions to buy the JPM stock back in June and sit on it pending an opportunity to sell a Covered Call on it.

Stock bought for $87.72 with a STP Loss of $85.90

Call sold a week or so later for $1.92 with a Strike of $91

On the day of expiry the stock dipped below $91 so I kept the stock.

My return on it for that month if my calcs are correct is 2.18%

(Plus a USD$50 Dividend on the 31st of July I think…. not sure I’m reading the numbers correctly so I haven’t included in the calculations).

Sold another call on the stock last week for $1.96 with a Strike of $92 and a STP loss of $90.30.

Best case scenario if the strike is reached on expiry on the 18th is ….

Profit on Stock = $485 ($92.00 – $87.715)

Income on CC = $198

Total = $683 or 7.78%

Worst case scenario if stock gets stopped out at $90.30 is …..

Profit on Stock = $258 ($90.30 – $87.715)

Income on CC = $198

Total = $456 or 5.19%

All in all, its a pretty good way to get myself going again – sooooo much still to learn through as I was reminded with that little hiccup last week and I really, really appreciate your support and encouragement!

Regards

Rae

Big or small, first or thousandth trade, it doesn’t matter – what matters is that you are doing it and we truly respect that.

Big Congratulations to Raewyn, who has secured her place in our Trader of the Year Competition, which will be drawn live, at this year’s Trading and Investing Summit. What about you??

Don’t hold back – nominate your entry for August as you close out of your trades, by emailing your results and back story through to the team through support@australianinvestmenteducation.com.au