Why trading headlines will help you lose money for no real reason: Let’s face it, we all love a great headline and right now, in financial markets. Nothing could summarise things more clearly than the above.

Let me explain. This week I was planning on writing an article on oil. Very topical given the price moves and having spent a fair bit of time at the airport – currently waiting for my fourth flight in four days. And the third one that’s been heavily delayed – catching up with the mainstream “misledia”/media.

Somehow, the slump in oil prices is now bad for the global economy

Ok, so it’s been a few years since I graduated. A fair chunk of my degree was Economics. And virtually all of my professional career has been around trading. Maybe I missed something back in the lecture theatre? A while back, rising oil prices were bad for the economy. And now falling oil prices are too? Come off it!!! Let’s be clear here, it’s one or the other as you can’t “run with the fox and the hounds” when it suits.

“Perhaps I have been wrong for all these years”

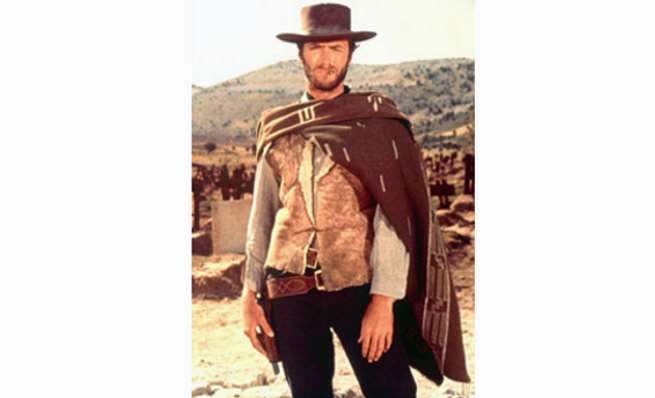

Ok so my wife will certainly enjoy reading that – maybe even print off and frame it – but in all seriousness, how is a falling oil price causing economic drama? Just like the old “spaghetti westerns” with Clint Eastwood, let’s take a look at The Good, The Bad and The Ugly.

The Good

The significant fall in oil prices is a major benefit for the global economy, effectively, reductions in all costs – transport, electricity, fuel, manufacturing, packaging and more. Sounds pretty good so far, and given the fragile state of global economics, could be just the crutch that the World needs right now. To steer things away from the recession the “misledia” believes we are heading for.

There is a working assumption here that those cost savings are passed on. After all, I’m sure you are fed up with hearing from airlines bellyaching about high fuel costs etc. crippling their business. This should be a sector that finally enjoys a great run. As will packaging.

Oil prices have halved which means we are getting ripped off badly…

In the same vein, will that lower oil price make its way to the bowser. Oil has halved in price – yet at the bowser, prices are not even close to troubling a dollar a litre. Which they really should now be. Speaking to one of my brokers in our LA office. He paid 76c a litre last night to fill up, on La Cienega Blvd, LA last night. To give you a comparison. Oil is a global commodity ie. same price anywhere (tax being the big variable) in the world so let’s hope it’s just lagging. Particularly given the twin turbo, 6 litre, W12 beast that I have on order for the New Year!!!

For Europe (where huge volumes of gas are imported from Russia) and the UK. Despite being producers, the economic benefits of lower oil will be a big help in stimulating the economy. For us too, here in Australia, this should be a massive boost. Probably equivalent to a 25bps interest rate cut or reduction in income tax. It’s that big a deal.

The Bad

Let’s take a look at a few “oil centric” economies and how the fall in crude has impacted on them.

Looking at Iran, figures suggest that to keep the local budget in balance. The government there requires oil at $136 plus a barrel. Firstly, that is at an extreme and historically high level and one on which any budget assumptions. Even the sort conjured up by “economic wiz” Bernie Madoff, could not hope to meet. And let’s face it if Iran spirals into a period of hyper inflation and economic hardship. There aren’t many that would be charging in to assist in a bailout.

In South America, Venezuela has for years been a thorn in America’s side – under former President Hugo Chavez. Radical politics, funded by petro-chemical wealth provided a platform for many extreme views. However, the slide in oil has bitten hard. Annualised inflation is currently north of 60%, civil unrest, violent protests and even the current President, Maduro, taking a pay cut. Will unlikely win much support for economic help from the rest of the world.

We can no doubt expect to see a substantial increase in scam emails too. Nigeria’s currency has been torched in the markets, seeing it plummet to new lows. Tough as that may be for locals, again, I don’t sense the global community piling in with a rescue package. Perhaps that “rich and recently deceased great uncle that needs a beneficiary bank account to deposit $15m” that we have all been emailed about. May finally materialise?

Turning to Russia, the Ruble has been under huge pressure in the currency markets. Dropping by around 30% vs US$. Sanctions from the west. As well as the drop in oil prices are hurting, with the economy effectively sliding into recession. Russian political hard lining and the handling of the MH17 disaster are unlikely to see the hat being passed around the international community, to help Russia out.

The Ugly

Spare a thought for Japan. I love Japan – the food, the culture and some of the best snow, particularly at this time of year, for those who love carving their way down the side of a mountain in Hakuba or Niseko. However, the past 25 years have been an economic disaster for the World’s third largest economy. Given that Japan needs to import all its’ raw materials (except cement) you could be forgiven for thinking that the move down in crude oil would be an economic gift from the gods. Sadly not.

Under Prime Minister Shinzo Abe, the government and Bank of Japan have been weakening the Yen, which now means despite a fall in crude oil prices, consumers in Japan are. Now faced with having to pay even more for Fuel! Add to that increases in tax, reductions in benefit and now this and there is no question that things, at least from an economic perspective, remain Ugly for Japan.

Great, thanks Andrew but where is the income opportunity here?

Translating news to trades – joining the dots and making a decision on where its’ all going and where the profits may be lurking is what trading and investing, successfully, is all about.

If you want to learn a bit more on how you can turn the above into trading opportunities – you know – actually taking a trade that has the potential to make you some extra cash, then click here.

Alternatively, if you are happy to sit back – no problem – good for you – but remember this, buy hold and hope is not working – in fact it hasn’t for a while, but then again, you probably already know that.

Check out how the banks and big resources have performed this year – and between them they are close to 60% of the Australian stock market. Will next year be any different??

Getting onto where the opportunities are – where there is a tailwind that can help you get ahead, not a headwind that is holding you back, makes a lot of sense and a lot of dollars too. We are just about to publish our Outrageous Market Predictions 2015 so keep your eyes peeled next week for an email from me, inviting you to download it. Meantime, if you want to know what we are trading now, where we are zoned in and squeezing the trigger on opportunity, then click here now and see for yourself.