Much has been made of the performance of the share markets, both here in Australia and in the US. Markets close to record highs, huge dividends and money being made left right and centre.

However, despite the facts, there are plenty out there that are yet to be convinced. I guess the question is what will it take to prove that the market is moving up, for some people?

Last week, the Business Development Manager from a financial institution – names withheld for very obvious reasons – sat in the boardroom of my Queensland offices and told us (me, and my head of sales training). That they were “gearing up ready for when the market turns up”.

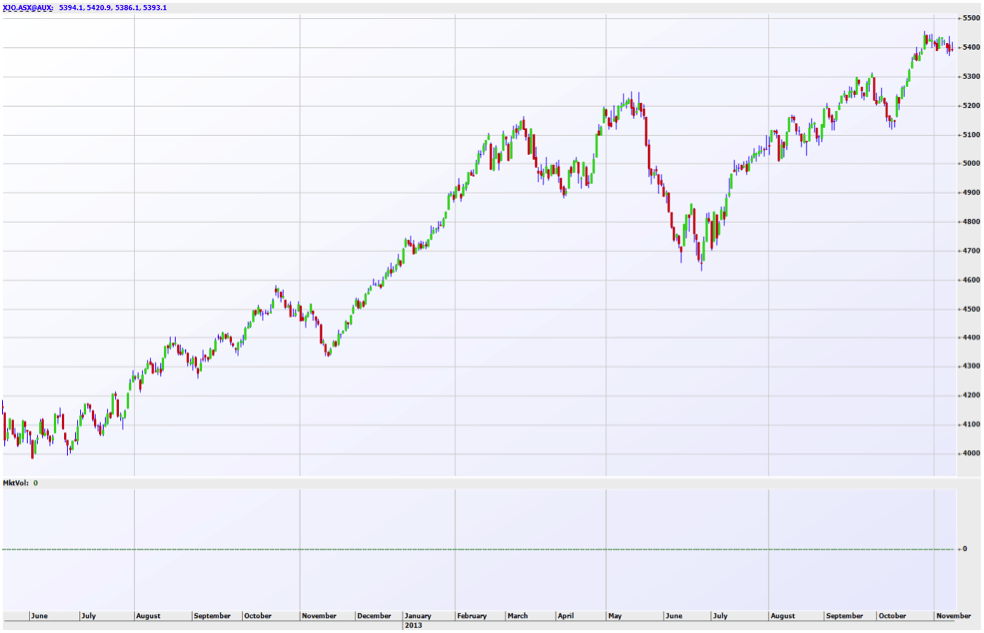

We both fell off of our seats – scrambled to bring up a 2x3m chart on the wall. To make the evidence legible and check that we hadn’t missed anything. Confirming the view (chart below) that this was possibly a little bit of a slow reaction.

I have yet to come to terms with that comment from a market player. What this did help me with, is coming up with a subject to write about this week. I had quite a lengthy list of topics, ranging from how directors of David Jones have so far avoided any insider trading charges, whether Roxy Jacenko’s husband will be prosecuted for insider trading, Wesfarmers and its spin off, the Non-farm payroll in the US and so on.

However, this one, “When is an uptrend not an uptrend” got the guernsey.

So what is an uptrend? Talking to the head technical analysts on the trading floor here, his view was a series of higher highs over a period of time. Alternatively, a series of higher lows, over a period of time, alternatively have a look at the moving average and see if that is going up – say a 50 day moving average, alternatively have a look at the index level and see if that is going up, or perhaps if still not convinced, take a look at the value of your share. The point is on any one of those metrics – light hearted or deadly serious, the market is going up.

How then, can some people still not see this?

The answer comes down to investor psychology pure and simple. Decisions are made when people arrive at an “action threshold” – the level that they chose to do something and open to seeing what is there.

There are many things that influence our action threshold. When we are in a good space, it is generally lower – we take action more easily. When we are in a less good space – perhaps feeling defensive – it can be higher and so on. Equally, there is projection – where we take things from the past and project them onto the present or future.

In this case, a number of investors who gamely got back into the market in 2010 post GFC, only to get caught again, in the pull back, have a very high action threshold for wanting to get back in again, today. Having been hurt before, the pain or frustration from being exposed to the market at the wrong time, in the wrong way, is a wound that will take a long time to heal.

However, the problem here, is by the time enough evidence has been shown – perhaps the market is through 6,000 and beyond, the easy money would have been made, and these guys will be arriving at the party late – taking on higher risk, buying higher in the trend, and ultimately, losing sleep as well as missed profits along the way. What’s more, if the market pull back for a rest following the strong move up, (pre-register for our Outrageous Predictions 2014 to see our forecast),these guys will likely get burned again, having no profits in the can, to cover a pull back. This may well finish them forever, when it comes to the stock market.

So how can we help you avoid this?

Learning more about our trading psychology – how our mind can influence our trading is key. A couple of years ago, I developed a program to help traders through this minefield – the program is Mindset Mastery. Included are 45 modules of trader training which we know will have a massive. Immediate and direct impact on your trading decisions.

Here is your gift

Yep, here is a present for you – we will give away 10 full copies of this program to those who feel that they could do with some help on their trading psychology. To be eligible* and have your chance to be one of those 10, register here. We will pick 1 winner every weekday from the 18th of November to the 29th of November 2013. Winners will be announced on our Facebook and Google+ page. By the way, this is not the massive offer I talked about the other week – that is still to come – this is a bit of an interim stocking filler!

Why now, you may ask…

Personally speaking, this year has dealt a lot of challenges – those close to me know what they are, but in spite of those challenges, the uptrend continues. This weekend, I have pushed through my action threshold and get to begin a new and exciting chapter in my life. Not in regards to trading, but in terms of marrying my beautiful soul mate and fiancé, Emma. So this is my wedding gift to you – register now and enjoy the program – I know it will help you greatly!

* Terms and Conditions

1. Prize draw is open to all registered for the giveaway by midnight Thursday, 28 November 2013 Australian EST Time. 2. Only one entry per person. 3. Prize draw: one entry drawn per weekday from the 18 November 2013 to 29 November 2013 at random from all qualifying entries by Thursday, 28 November 2013, will receive Mindset Mastery Online Education Course with a maximum of 10 giveaways. 4. No cash alternative. 5. Winner will be notified via Facebook, Google+ and Directly 6. Australian Investment Education Pty Ltd is the arbiter of this promotion and in the event of any dispute its decision is final. 7. Where not covered here, the relevant Australian Investment Education Pty Ltd rules will apply.