Sequester cuts to the US economy – how it will affect the US economic recovery. Headlines over the last few months have promoted fear amongst investors. Over the US Federal Budget and the National Debt Ceiling, which is soon to reach its $16 trillion dollar cap. That is $16,000,000,000,000! Yet again the Sequester is looming, and this could cause renewed volatility in the markets.

The National Debt Ceiling is the level imposed by Congress on how much debt the United States can carry at any given time. It is imposed by the Statutory Debt Limit, which is the outstanding debt in US Treasury Notes.

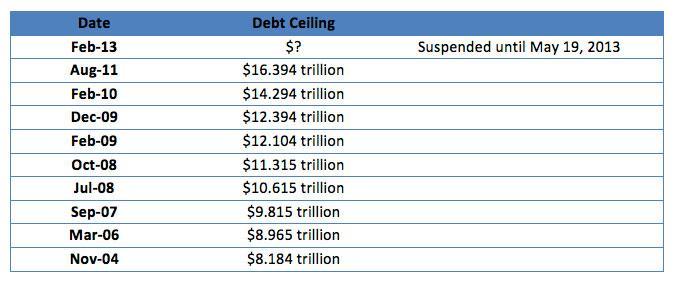

In the last 10 years, Congress has raised the debt ceiling ten times; 4 times in 2008 and 2009. In more recent years, however, Congress has delayed raising the debt ceiling due to political positioning between the Democrats and the Republicans. And this has caused a great deal of uncertainty in the investing world.

The following table denotes the last 10 adjustments to the debt ceiling, which has doubled in less than 10 years. For a full history, CLICK HERE to view data from 1919 to the present.

What is the Sequester?

The definition of the term Sequester is to “Isolate or Hide Away (someone or something)”. In terms of the US Federal Budget, it refers to automatic cancellation of budgetary resources as established in the Budget Control Act of 2011. The purpose is to reduce spending if Congress did not pass, and the President did not sign, legislation reducing the deficit by $1.2 trillion by January 15th 2012.

What it means right now is that there is a potential 8% across the board spending cuts to the government budget coming on March 1st. The impact of this would be $85 billion worth of cuts.

Where will it impact the US economy?

The following are the sectors that will be greatly affected:

• Food inspection = $2.2 billion

• National Parks = $110 million

• Border Secutiry = $754 million

• Federal Prisons = $355 million

• Law Enforcement = $480 million

• Nuclear Regulatory Commission = $55 million

• 1 million government workers could be asked to take unpaid leave for up to 22-days, which equates to $7 billion in lost wages, having a direct impact on consumer spending – the key driver of the US economy

Having cuts in the budget that will remove $85 billion at a time when the economy is in a Recovery mode, could be the straw that breaks the camels back. It’s the reason why investors were spooked after the Presidential elections. And why we have seen the markets fluctuate in the last week.

There’s a strong probability the President will “Kick the Can down the road” by postponing the sequester decision (yet again). But the problem will still remain. If the Budget cuts go through, then this will have a clear and defined impact on the economy. This leads us to believe that through the middle of 2013. We will have a short to a medium-term bear market as investors look to take profits from what they have made over the last several months.

UPDATE

Since we published this article last week, the overall market’s reaction has settled down, with the spending cuts seen as a necessary step. What was particularly interesting, however, was the reaction by the US general public, in relation to the Sequester, and what they believe it means for them. Check this out……Confusing Question of the Day – Obama Pardons The Sequester