What’s one industry that will never go out of fashion? As a mix between healthcare and technology, it comes as no surprise that Cerner Corporation (NAS: CERN) has dominated headlines. And continued to make gains in the stock market this year. As my top stock tip for June, let’s take a look into why CERN provides. Such a strong case for investment this month. And not only based on fundamentals but also on the basis of high future growth of earnings.

Especially, For those who maybe aren’t familiar. CERN is a multi-national company with a market cap of about $23.81B USD that provides devices. Software, equipment, and hardware for medical practices across the globe. Amidst a raging pandemic, the need for such a supply of medical equipment has never been more important. In what is a top performing sector of the stock market.

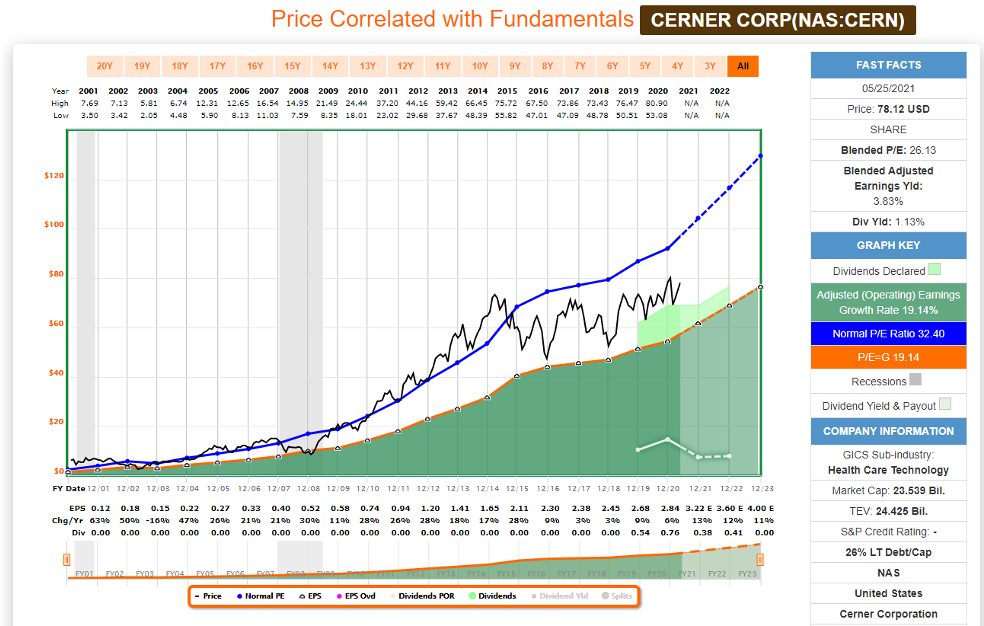

Fundamentally, CERN is an undervalued stock and is trading at around a 9% discount based on where fair value sits as per my research. Interestingly enough, the healthcare sector tends to be quite the defensive one. And using a traditional method of valuation such as the P/E ratio we can see that CERN is ‘cheap’. And Albeit would appear to have the earnings growth similar to that of a pure tech stock like an Amazon or Google for example. Their hybrid exposure to technology in the healthcare sector essentially allows CERN to have the best of both worlds. If we take a look at the graph below which correlates CERN’s share price with fundamentals. My claim that this stock is undervalued is validated given. We can see their share price is trading well below their normal PE (the blue line).

More importantly, though, CERN’s adjusted operated earnings growth sits. At a whopping 19.14% and would appear to have a very smooth earnings up-trend. As justified by the orange line. Not to mention their high blended earnings yield and low debt ratio of just 26. And CERN ticks all the boxes when it comes to making a case for financial investment. In Addition, Based on the expectation of future growth. With the massive shift from high growth. The Momentum stocks to more cyclical stocks tied to the reopening of the economy. And having a defensive stock like CERN which really covers both cases in your portfolio. And can also act as a defensive hedge and provide a nice balance of sectors – something we covered in the 47th episode of our podcast on “Sector Rotation” on the Money and Investing Show.

The way I’ll be looking to gain exposure to CERN is via the use of bought, long dated call options. As a high-priced stock listed in USD. It can be hard to trade this stock as a covered call given its capital intensity for most accounts. Rather, I’d be looking to utilize one of our strategies from the advanced options program. Being bought calls – which is essentially owning the rights (ie. using leverage) to buy the stock at some time in the future giving all the benefit of upside potential, albeit with a limited amount of risk (something our traders of the month do all the time – Click Here). For anyone looking to learn how to follow along and do this yourself, book into one of our workshops through the following link – Cashflow on Demand Workshop