Confidence is a funny thing. What are the Stock markets doing right now and why?

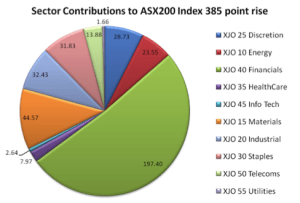

The world’s stock markets are running – Pamplona style, with the bulls. Money has been pouring back into the market for about 6 months now.

The world’s stock markets are running – Pamplona style, with the bulls. Money has been pouring back into the market for about 6 months now.

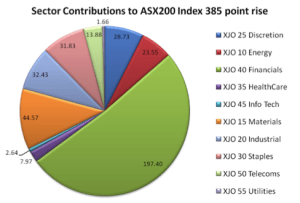

The Rise and Rise of Trading Bank stocks. As the stock market starts to show signs of topping out. We take a look at the

“The Stock Market is booming” – are you still sitting on the sidelines, as the bulls charge by? Today, as I write my weekly article.

Trading Strategies that work. I’ve heard from numerous clients. And colleagues over the last 18-months. Describing how the current markets are the hardest they have

10 years of investment performance – Do you stay between the flags and catch the wave, or get dumped – your “Call” One article that

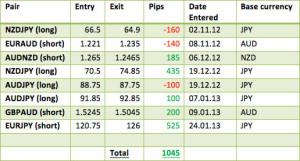

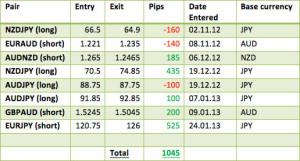

1045 Pips of profit – so when the RBA meets to discuss interest rates…Most people – those with a mortgage – swiftly calculate that this

The world’s stock markets are running – Pamplona style, with the bulls. Money has been pouring back into the market for about 6 months now.

The Rise and Rise of Trading Bank stocks. As the stock market starts to show signs of topping out. We take a look at the

“The Stock Market is booming” – are you still sitting on the sidelines, as the bulls charge by? Today, as I write my weekly article.

Trading Strategies that work. I’ve heard from numerous clients. And colleagues over the last 18-months. Describing how the current markets are the hardest they have

10 years of investment performance – Do you stay between the flags and catch the wave, or get dumped – your “Call” One article that

1045 Pips of profit – so when the RBA meets to discuss interest rates…Most people – those with a mortgage – swiftly calculate that this

Wealth Magnet Pty Ltd (ABN 52 618 868 830) trading as Australian Investment Education is a Corporate Authorised Representative (CAR no. 1255231) of Grange Financial Services Pty Ltd (AFSL No. 488609).

The information provided by Wealth Magnet Pty Ltd t/a Australian Investment Education to you does not constitute personal financial product advice. The information provided is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. Wealth Magnet recommends that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Past performance of any product discussed is not indicative of future performance. (We urge that caution should be exercised in assessing past performance. All financial products are subject to market forces and unpredictable events that may adversely affect their future performance). We may at times refer to third parties. Details of these third parties have been provided solely for you to obtain further information about other relevant products and entities in the market. Wealth Magnet has no control over the information third parties have, or the products or services offered, and therefore make no representations regarding the accuracy or suitability of such information, products or services. You are advised to make your own enquiries in relation to third parties. Our inclusion of any third party content is not an endorsement of that content or the third party.

Wealth Magnet Pty Ltd | Address: Level 1, 87-89 Upton Street Bundall QLD 4217 | Phone: 0755854285

Wealth Magnet Pty Ltd (ABN 52 618 868 830) trading as Australian Investment Education is a Corporate Authorised Representative (CAR no. 1255231) of Grange Financial Services Pty Ltd (AFSL No. 488609).

The information provided by Wealth Magnet Pty Ltd t/a Australian Investment Education to you does not constitute personal financial product advice. The information provided is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. Wealth Magnet recommends that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Past performance of any product discussed is not indicative of future performance. (We urge that caution should be exercised in assessing past performance. All financial products are subject to market forces and unpredictable events that may adversely affect their future performance). We may at times refer to third parties. Details of these third parties have been provided solely for you to obtain further information about other relevant products and entities in the market. Wealth Magnet has no control over the information third parties have, or the products or services offered, and therefore make no representations regarding the accuracy or suitability of such information, products or services. You are advised to make your own enquiries in relation to third parties. Our inclusion of any third party content is not an endorsement of that content or the third party.

Wealth Magnet Pty Ltd | Address: 36 Upton Street, Bundall QLD 4217 | Phone: 1300 304 500